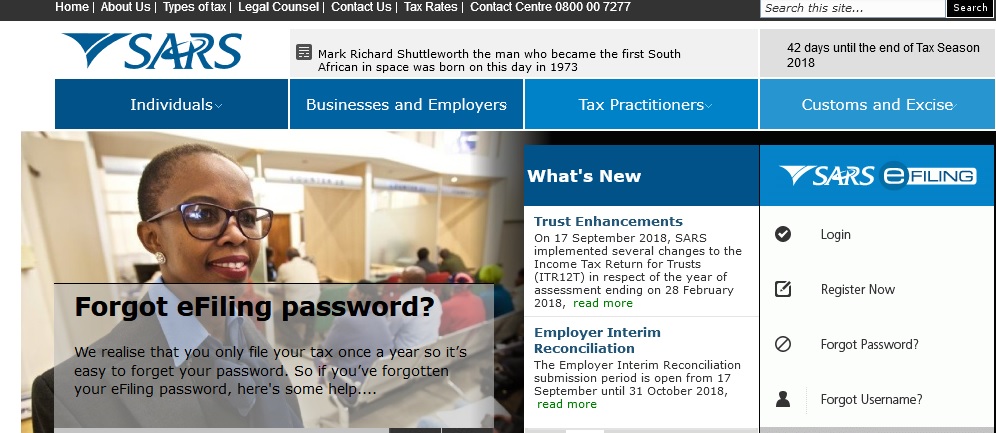

Name of the Organization : South African Revenue Service

Type of Facility : Register For eFiling

Country : South Africa

Website : http://www.sars.gov.za/

SARS eFiling

** SARS eFiling is a free, online process for the submission of returns and declarations and other related services, for more information visit the eFiling Services page.

Related : SARS Taxpayer Registration South Africa : www.statusin.org/1988.html

eFiling is a free, simple & secure way of interacting with SARS from the comfort and convenience of your home or office.

This free service allows taxpayers, tax practitioners and businesses to register free of charge and submit returns and declarations, make payments and perform a number of other interactions with SARS in a secure online environment.

** Taxpayers registered for eFiling can engage with SARS online for the submission of returns and declarations and payments in respect of taxes, duties, levies and contributions.

** The eFiling service is on a par with international standards, being comparable with services offered in the United States (US), Australia, Singapore, Ireland, Chile and France.

eFiling Benefits :

** No more waiting in queues, finding parking or worrying about office hours. Once registered, eFilers can submit returns, view their tax status and make payments to SARS electronically 24 hours a day!

** eFilers are also given more time to make their submissions and payments. Individual taxpayers and trusts have more time to submit their returns which means longer to pay any additional income tax. And if you’re a business paying VAT, you get until the last business day of the month to pay it over (rather than the 25th of the month for manual filers)!

** You also have a full history of all submissions, payments and electronic correspondence available to you at the click of a button through the innovative reporting tool.

** eFilers can also receive SMS and email notifications to remind you when submissions are due.

** The simplicity of the process results in fewer errors and creates a quicker processing cycle for individuals and businesses.

** Isn’t it time you joined more than 2.7 million individual taxpayers and 350 000 businesses who are enjoying all the ease, convenience and peace-of-mind that eFiling offers-

How to register :

** As a registered taxpayer you can register to use the eFiling service which allows you to file a return, make payments, request a tax clearance certificate as well as many other services.

** To register as an eFiler go to the SARS eFiling website www.sarsefiling.co.za and click on the REGISTER button. You will be guided through a six-step process, which will take between five and ten minutes to complete.

** You can register as an individual taxpayer, a tax practitioner or organisation. Once you have registered as an eFiler and you are flagged as an electronic filer with SARS.

** Returns are made available for completion and submission on your eFiling profile. You may register additional users and organisations within SARS eFiling.

Register Here : http://www.sarsefiling.co.za/Register.aspx

How to upload Supporting documents on eFiling :

Taxpayers who wish to upload supporting documents (relevant material) to SARS eFiling for submission to the South African Revenue Service (SARS) should make sure that the documents adhere to the required standards

** The file type may be .pdf, .doc, .docx, .xls, .xlsx, .jpg and .gif

** The maximum allowable size per document may not exceed 2 MB and a maximum of 20 documents may be uploaded

Upload failure can be caused in the following instances :

** Document with a file name containing special characters such as * # AT ! & > and others

** Documents with the same name in cases where more than one document is uploaded

** Password protected documents, that cannot be opened without a specific password

** Spreadsheets with multiple sheets; information should only be on one sheet

** Blank or empty documents.

Contact Us :

If you have any queries please contact the SARS Contact Centre on 0800 00 SARS (7277) between 08h00 – 17h00 (excluding weekends and public holidays).

View Comments (3)

I have a problem in registering e-filing and it fails the whole time.

Information available from the Official Website :

JOY INGRID TYRRELL

ID 6311150223084

CASE NO 219332000

I WISH TO CONFIRM MY NEW RESIDENTIAL AND POSTAL ADDRESS AS

18 8TH AVENUE

NORTHDMEAD

BENONI

I ALSO WANT TO REGISTER AS AN EMPLOYER OF 4 MEMBERS OF STAFF.