Organisation : NJ Division of Taxation New Jersey Individual Income Tax

Type of Facility : Income Tax Refund Status

State : New Jersey

Country : United States of America

Home Page : https://www16.state.nj.us/TYTR_TGI_INQ/jsp/prompt.jsp

NJ Income Tax Refund Status

Welcome to our Income Tax Refund Status Service. You may use this service to check the status of your New Jersey income tax refund.

Related : New Jersey Vehicle Registration & Renewal : www.statusin.org/7954.html

To do so, you must know your Social Security Number and the amount of your refund.

** Please read the following information about our process for sending refunds and then click on the Continue button if you would like to find out the status of your refund.

** We process individual income tax returns on a daily basis beginning in January. This processing includes the following:

** Transferring information from the returns to the State’s automated processing system

** Checking to see that we transferred the information correctly

** Checking to see if the returns had any mathematical errors

** Checking for inconsistencies and other possible errors

** The majority of this processing is automated. However, some returns go through an additional manual process to make sure they were filed correctly. This manual process includes checking to make sure income, deductions and credits were reported correctly.

** In some cases, we can’t complete the processing of a return without additional information from the filer of the return. If that’s the case with your return, we’ll send you a letter instead of sending your refund.

** Generally, we process returns filed electronically (those filed online using our NJ WebFile service or filed by computer software) faster than returns filed on paper.

** Processing of electronic returns typically takes a minimum of 4 weeks.

** Processing of paper tax returns typically takes a minimum of 12 weeks.

** Returns that require manual processing may take 12 weeks or longer whether the return was filed electronically or on paper.

** You should only use the Online Refund Status Service if you filed your return at least 4 weeks ago (electronically) or 12 weeks ago (paper).

** Click on the button below to continue.

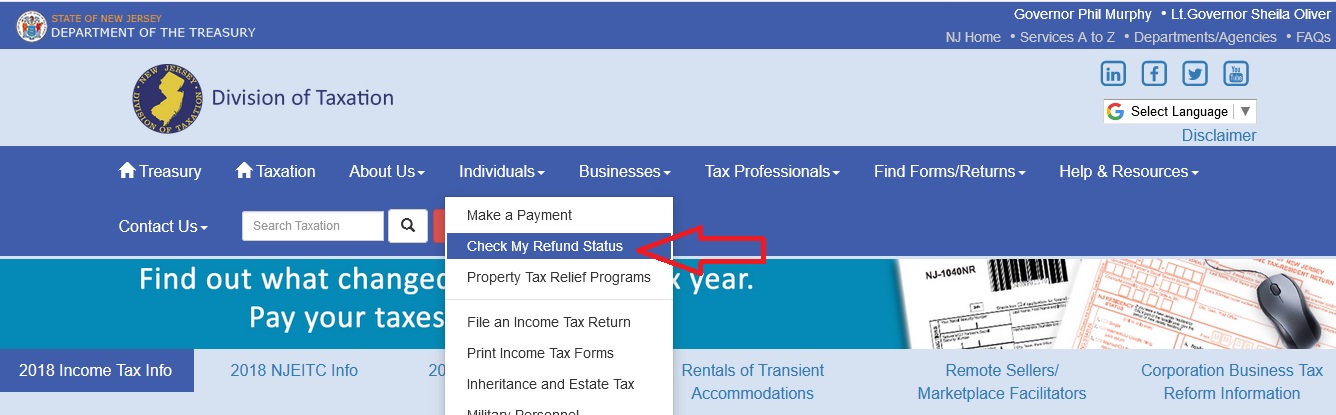

How To Check

Check the Status of Your New Jersey Income Tax Refund

To follow the progress of your refund, enter your Social Security number and the amount of the refund as listed on your tax return.

Then select the appropriate tax year :

Social Security Number

Requested Refund Amount

Click on submit button.

Tax Rates

Gross Income Tax :

** The New Jersey gross income tax rates for 2016 remain the same as the rates that were in effect for 2010.

Tax Table : (2016 Returns)

** If your New Jersey taxable income is less than $100,000, you may use the New Jersey Tax Table or New Jersey Rate Schedules. When using the tax table, be sure to use the correct column.

Tax Rate Schedules : (2016 Returns)

** You must use the New Jersey Tax Rate Schedules if your New Jersey taxable income is $100,000 or more. Use the correct schedule for your filing status.

Tax Rate for Nonresident Composite Return :

(Form NJ-1080C) 2016 Returns

NJ-WT :

** Instruction booklet for employers, payors of pension and annuity income and payors of gambling winnings.

Supplemental NJ-WT :

** Supplemental withholding tables.

UI/DI/FLI Contribution rates :

** Unemployment Insurance, Disability Insurance, Workforce Development/Supplemental Workforce Funds, Healthcare Subsidy Fund, Family Leave Insurance