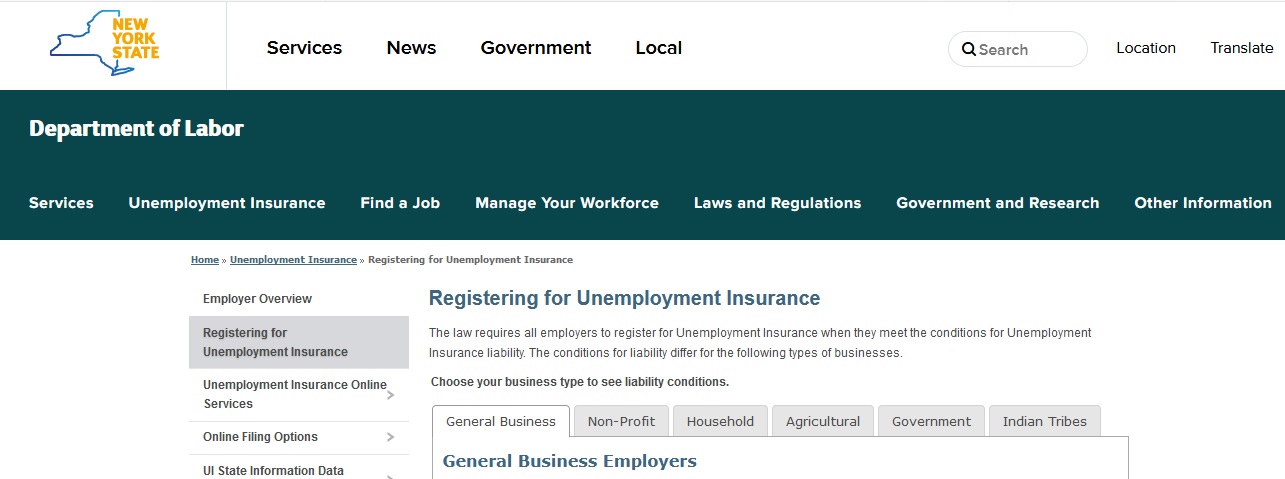

Organization : Department of Labor New York,USA

Service Name : Registering for Unemployment Insurance

Country: New York,USA

Website : http://labor.ny.gov/ui/employerinfo/registering-for-unemployment-insurance.shtm

Register Here : https://applications.labor.ny.gov/eRegWeb/

Labour Registering for Unemployment Insurance

** The law requires all employers to register for Unemployment Insurance when they meet the conditions for Unemployment Insurance liability.

Related : Department of Taxation & Finance Apply For An Extension Of Time To File An Income Tax Return : www.statusin.org/26261.html

** The conditions for liability differ for the following types of businesses.

** Choose your business type to see liability conditions.

General Business Employers :

General business employers are liable on :

** The first day of the calendar quarter you pay remuneration of $300 or more, – or –

** The day you obtain any or all of the business of a liable employer

Non-profit Employers :

Non-profit employers are liable :

** On the first day of the calendar quarter you pay remuneration of $1,000 or more, – or –

** As of the first day of the calendar year you employ four or more workers on at least one day in each of 20 different weeks during that year or the prior calendar year

Household Employers :

** Employers of household help are liable the first day of any calendar quarter you pay remuneration of $500 or more.

Agricultural Employers :

Employers of agricultural labor are liable as of :

** The first day of the calendar year you employ ten or more workers in agricultural labor on at least one day in each of 20 different weeks during that year or the prior year – or –

** The first day of the calendar quarter you pay remuneration of $20,000 or more to agricultural labor workers – or –

** The first day of the calendar quarter you pay any remuneration to agricultural workers if you are liable in any other state under FUTA with respect to farm workers

A farm labor crew leader who provides and pays the farm crew to work in agricultural labor for another employer is the employer of the crew members if the crew leader :

** Meets any of the conditions of liability for agricultural employers – and –

** Holds a valid certificate of registration under the Federal Farm Labor Contractor Registration Act of 1963 – or –

** If most of the members of the crew operate or fix mechanized equipment the leader provides – and –

** Are not employees of the other employer

If the above conditions are not met :

** The crew leader is not liable – and –

** The crew members are employees of the farm operator

Government Employers :

** Government employers are liable the first day of the calendar quarter you pay remuneration to employees in covered employment.

** It does not matter how much remuneration you pay or the number of employees.

Indian Tribes :

** All Indian tribes, as defined in Section 3306(u) of FUTA, are liable under the New York State Unemployment Insurance Law the first day of the calendar quarter you pay remuneration to employees in covered employment.

** It does not matter how much remuneration you pay or the number of employees.

Before you Register :

** Before you register, you must obtain a Federal Employer Identification Number (FEIN) from the Internal Revenue Service (IRS).

** If you need an FEIN, you can download an application (Form SS4) or apply online at the IRS web site.

** You can also obtain an application by calling the IRS at (800) 829-3676.

How to Register as an Employer :

** You must complete an employer registration form for us to decide if you are liable under the New York State Unemployment Insurance Law.

** To register online (Business Employers and Household Employers of Domestic Services only) go to our online registration page.

** This service is not available to Non-Profit Employers, Agricultural Employers, Governmental Employers and Indian Tribes at this time.

** These employers must use the appropriate form found below.

** If you do not qualify as a Domestic, Agricultural, Nonprofit, Governmental or Indian Tribe, please register as a General business employer.

** If you have any questions about registration, call (888) 899-8810.

After you Have Registered :

** We assign each liable employer an eight-digit employer registration number.

** Please use your registration number on all correspondence, quarterly returns and payments that you send to us.

** If you are liable for Unemployment Insurance, you must electronically submit a Quarterly Combined Withholding, Wage Reporting and Unemployment Insurance Return (Form NYS-45).

** File the NYS-45 online by visiting the Department of Taxation and Finance website.

** For more information, call (888) 899-8810.

** You will receive a poster Notice to Employees that tells your employees their jobs may be covered for unemployment insurance.

** Household employers do not receive this poster.

** You must display the poster at each of your business locations, where your employees can easily see it.

** Call (888) 899-8810 for more copies.