Organization : Tax Administration

Facility : Check Refund Status

Country : Jamaica

Website : https://www.jamaicatax.gov.jm/web/guest/home

Terms & Conditions : https://www.statusin.org/uploads/28837-Check-Refund.pdf

Jamaica Tax Check Refund Status

Tax Administration Jamaica continues to change the way it does business through its value added services that are convenient, secure, and fast.

Related / Similar Facility :

Apply for GCT Deferment Jamaica

NHT Refund Application Form for 2020

To this end, the Revenue Administration Information System (RAiS) is now in the second phase of its implementation. This means that taxpayers will be able to do much more with our web service offerings, which will greatly improve the way taxpayers interact with us.

Taxpayers who previously submitted a request for a refund can now check the status of their request online.

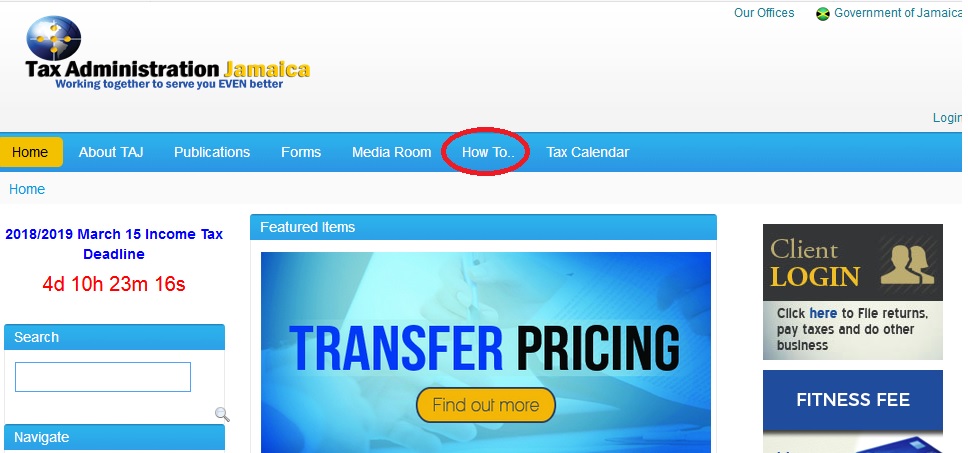

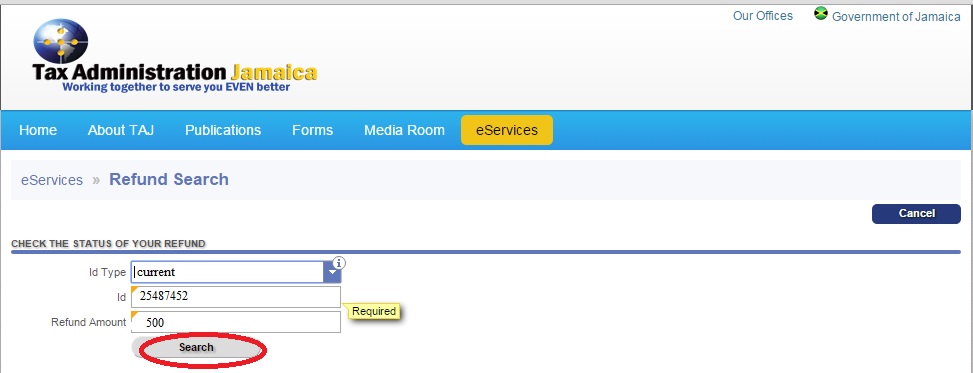

In order to inquire on the status of a refund request, the taxpayer can visit the TAJ Website and log in to the TAJ Web Portal, then select the “Check Refund Status” hyperlink. Enter a valid ID Type, ID, and refund amount and click “Search” to generate information showing the stage that the refund is currently

Note : The ID Type being referred to is“TRN” and the ID is the actual 9‐digit TRN. Once valid information is entered in the fields provided, a message displaying the current status of the refund will be displayed.

If the information entered is invalid, the following message will be returned:“There are no refunds that match your ID and Amount.”

Categories Of Refund

Income Tax

** Study Leave Cases

** Self Employed Individuals

** Companies

** Expatriate Cases

Pensioners/Golden-agers :

** Residents

** Non Residents

** Redundancy Cases

** Unemployment Cases

** Certified Disabled

** Minors

** Other PAYE Cases e.g. Employers

** Commissioned Sales Agents e.g. Insurance Sales Agents

With-Holding Tax :

** Exempt Bodies

** Prescribed Bodies

General Consumption Tax :

** Registered Taxpayer (Return)

** Non-registered Taxpayers (Claim Form

Documents Required

Income Tax :

Study Leave Cases :

** Confirmed TRN

** Completed IT05 for each year of study leave

** Loan/Bond Agreement

** P24 for each year in which salary was paid while on study leave

** Letter of Award stating the commencement and termination date of the course of study.

** Resumption letter signed by the employee and acknowledged by the employer.

** Letter advising of vacation leave entitlement at the commencement of the course and whether leave was utilized during the course of study.

Self Employed Individual :

** Confirmed TRN

** Completed IT01 Form

** P24 from employer if income includes emoluments.

** Financial Statement of Schedule 1, 4.

** With-holding Tax/Dividend Certificates

** Capital allowances schedule (Schedule 2)

** Income Tax Computation

Company Cases :

** Confirmed TRN

** Financial Statement

** With-holding Tax or Dividend Certificates

** Completed IT02 Form

** Income Tax Computation

** Capital Allowances Schedule (Schedule 2)

** Copies of Contractors levy receipts where applicable

Expatriate Cases :

** Confirmed TRN

** P45 for the current yearof employment

** P24 for the past years of employment

** Work Permit/Exemption Letter

** Copy of employment contract

** Passport (valid) verifying residency

** Plane Ticket or Itinery

** Completed IT05 Form for relevant years

About Us

Tax Administration Jamaica (TAJ) proudly operates as the country’s premiere revenue collecting agency.

In keeping with our mission, our primary goal is to foster voluntary compliance, collect the revenue due in an equitable and efficient manner, contribute to a competitive business environment and facilitate economic growth and development.

Through excellent service by our highly skilled staff, and in capitalising on the strengths of the organisation, our primary focus, as we strive to accomplish the broad goals and objectives set out by the Ministry of Finance and Planning and in general the people of Jamaica is one that embodies the mantra, “Working together to serve you Even better”.