Name of the Organization : Absa Bank

Type of Facility : Absa Account opening Procedure

Country: South Africa

Website : https://www.absa.co.za/personal/

ABSA Account Opening Procedure

Switching to Absa couldn’t be easier. Simply choose the bank account that suits your lifestyle, then fill in the online application form.

Related : Absa Bank Apply For Platinum Credit Card South Africa : www.statusin.org/6273.html

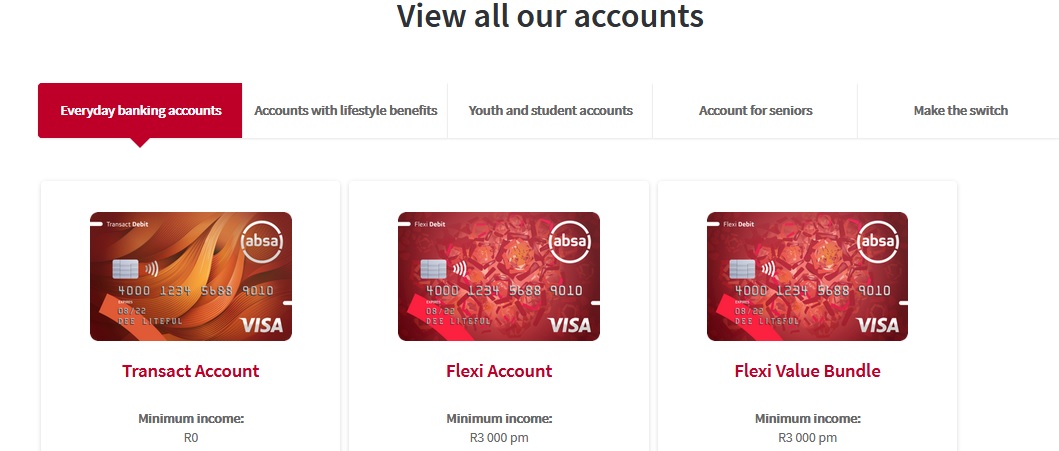

Choose your account

** Platinum Account Live in style with our premier cheque account and get added banking convenience through our Priority Service. Minimum income: R25 000

** Gold Account: Great value for money that reflects your gold earnings status. Minimum income: R8 000

** Flexi Value Bundle: Bank for a market leading low monthly fee and get a host of free transactions and value added services. Minimum income: R2 000

Online Application :

http://www.absa.co.za/Absacoza/Individual/Switch-to-Absa/Open-an-Absa-Account#

Choose your Pricing Plan

** Value Bundle: Get a bundle of transactions for a set monthly fee

** Pay-As-You-Transact: Pay a small monthly fee, then only pay when you transact

Open an Absa account now.

Once you have your new Absa account, you can switch your salary and debit orders. Simply fill in an online Debit Order and Salary Switching Request and we’ll take care of the rest.

Complete this Debit Order and Salary Switching Request and email it to switching [AT] absa.co.za or fax it to 086 753 3537.

Contact Switching:

Call us on 0860 100 372

E-mail us at switchingqueries [AT] absa.co.za

Visit your nearest branch

Tips to avoid cheque fraud :

Be especially vigilant when it comes to suspicious cheque deposits into your account, and take note of the following :

** Report lost, stolen or missing cheques immediately.

** Contact the Absa Fraud Hotline (0860 557 557) as soon as you suspect fraudulent activity on your account.

** When filling out a cheque, never leave space in front of the name of the payee or the amount in figures. Draw a line through all unused spaces.

** The payee details should appear in full, e.g. “South African Revenue Services”, rather than “SARS”.

** Keep your cheque book in a safe place.

** Don’t sign blank cheques.

** Reconcile your bank statements regularly.

** To ensure that a cheque is paid into the intended beneficiary’s account, the cheque must be marked with the words ‘Not Transferable’ between two transverse lines at the top of the cheque.

** Always keep your cheque book separate from your credit cards, ATM cards or any document that bears your signature.

** If you have to post a cheque, place it in a non-transparent or dark envelope without any staples/paper clips.

** Other payment methods are safe and convenient and can save on bank charges. These include internet banking, mobile banking, telephone banking, ATM payments, debit orders and future-dated payments.

** You can stop cheques on Absa Online.

** If you sell something, never release goods until the payment has cleared into your account.