Name of the Organization : Zambia Revenue Authority

Type of Facility : Tax Payer eReturn Filing

Country: Zambia

Website : https://www.zra.org.zm/

How To File ZRA Tax Payer eReturn?

This guide has been prepared with a view to provide a step-by-step guidance to the taxpayers in filing e-returns. Filing of e-return will save time and will be more convenient for the taxpayer.

Related / Similar Service :

ZRA Tax Payer Registration

A computer with internet connectivity is required for the purpose. There are six easy steps to file ZRA Tax Payer e-returns.

These steps are:

1. Login into the portal

2. Download e-return form/s

3. Filling the details in the form/s

4. Validate the form/s

5. Uploading the form/s

6. Obtaining Acknowledgement Receipt

Login into the Portal

** To Login the web portal, connect to Internet and type in zra.org.zm. In the address bar.

** Once the web portal is connected, the Home page will appear

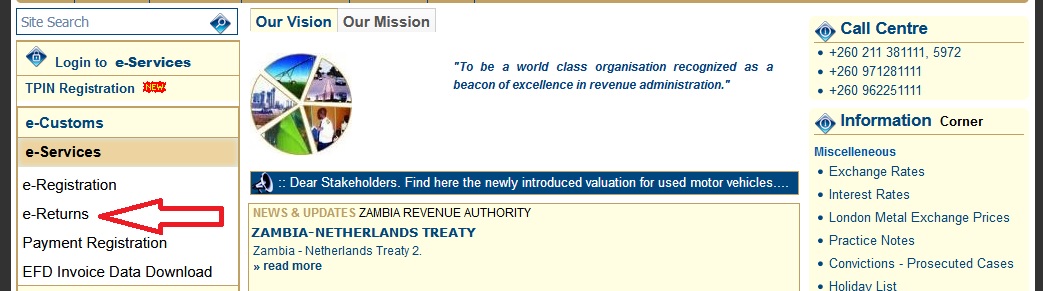

** To Log onto the web portal, click on Login in Left Menu

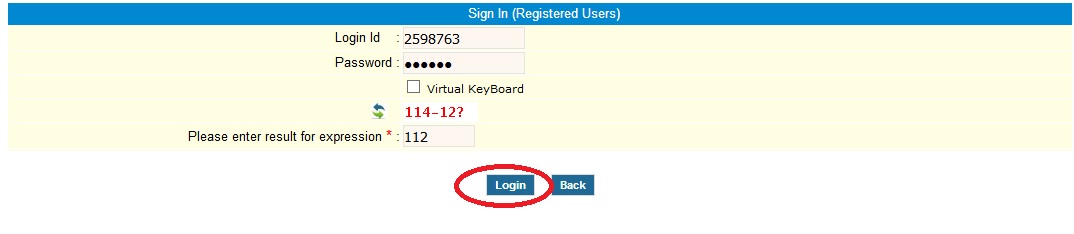

** After clicking on Login, enter the Login Id and Password (for your login ID and password kindly refer to the ‘How to sign up guide’).

** After login a new screen will open.

** Click on e-Return from e-services in left menu. A new screen will be open

How To Download ZRA e-Returns Form?

** To get return, you have to download the template from the ZRA Portal. It is advisable to download the template once and store for future use.

** After selecting the tax type and/or return type, the screen will be displayed.

** To download the e-Returns forms select the appropriate tax type and click upload.

** Save the downloaded return e-Form on your computer.

** After downloading the template, data can be entered.

Filling in the Return template/form

** Fill in the template with all the applicable details

** (Note – You should have Microsoft Excel 97, 2000, 2003, 2007 or 2010 installed on your computer for this purpose.)

** After downloading the template, enable Macros. If you do not know how to do that refer to Excel Help sheet

How To Validate ZRA e-Returns Form?

** After filling in the form, click the Validate button.

** If there are errors a list of these will be displayed and you will need to correct the data.

** If there are no errors in the return template a message box will appear.

** Click ‘Yes’ as per above screen, then the system will prompt you to save the template on your computer to Validate ZRA e-Returns Form.

Upload and submit the form

** To submit the return for a given period the screen below will appear

** Select period for which return is to be filed.And click ‘Check’ to check whether you are authorised to file return for the given period or not.

** However, if you click “Upload” a pop up confrimation message will appear

** After filling up the details, click on ‘Upload’. Details will be verified by the system and if they are found correct, system will give a no error message.

** If there are errors in the template a list will be displayed.

** The system will not allow submission/upload of returns sheet until all the errors are corrected.

** Click on the ‘Submit’ button to save returns data

Functions of Zambia Revenue Authority

The Zambia Revenue Authority (ZRA) is a government agency responsible for collecting taxes in Zambia.

The ZRA has a number of functions, including:

** Assessment and collection of taxes and duties: The ZRA is responsible for assessing and collecting taxes and duties on a variety of goods and services. This includes income tax, value-added tax (VAT), customs duty, and excise duty.

** Enforcement of relevant statutory provisions: The ZRA is responsible for enforcing the relevant statutory provisions relating to taxes and duties. This includes investigating suspected tax evasion and fraud, and taking enforcement action against taxpayers who fail to comply with the law.

** Facilitation of international trade: The ZRA is responsible for facilitating international trade by providing clearance services for goods imported and exported from Zambia.

** Advisory on aspects of tax policy: The ZRA is responsible for providing advice to the government on aspects of tax policy. This includes providing information on the impact of tax policy on the economy, and making recommendations on how to improve the tax system.

View Comments (30)

Is there any simple way that will help me to successfully file my return or do I need to login on another zra platform for me to see return filling provision?

If so kindly give more guidance on how to do it, the system is too complicated.

I am based in Muchinga Province i recently registered for GTCC under Minilis Civil, Construction. trying to submit NIL return on electronically i am failing.

NEED GUIDANCE

I am trying to submit nil returns both for Turnover tax and Paye but the system is giving me a different page rather than the one i alwsys use. Please advise if there are any changes.

I'm failing my returns on my company Demago security company because it's not yet in operational

I need guidance as well how to do will return. Is there a number to call for guidance? Kindly help pls

Could you kindly advice what must I do i dont receive your mails for my tax return reminder from your office and whenever i try to log in for my tax returns i can't get in Phichusi Constructions and general dealers Tpin N0. 1003576146Please help me out

I would like to do my E-filling of tax returns

How to make returns?

i wanted to make a return on my phone but when i put my TPIN it refused,what should i do?

I applied for tax clearance renewal. How do I check whether it is renewed?

I wanted to close the business as my partner has not contacted me for over a year and I don't know where he is?

Please tell, what am I supposed to put in the Login ID, I put my TPIN, it refused. I put my newly created password, it also refused.

Please, can you make things simple on filling reports.

I have been trying to submit nil returns but the system is showing different page.

I want to download the tax return forms and be able to submit returns through online.

I always find it difficult to submit PAYE nile returns. I always seek the assistance of ZRA officers who most of the times are unwilling to help. Its not everyone who can operate a Computer, and I suggest you type instructions on how to submit both PAYE and TURN OVER taxes online and should be in all branches across the country. Otherwise we will be failing and will keep on accumulating penalties.

Let me know, do I need to register or send request for tax online for a person business.

How can I submit nil returns?

Your system is too complicated for us in rural areas where the internet is slow and poor network connectivity. Please consider us in this one.

HOW CAN I SUBMIT A NIL RETURN? I FAILED TO SUBMIT IT.

How can I submit returns? Please help me.

How can I submit NIL returns online?

How can I submit NIL returns online?

Information available from the Official Website :

One needs to download a template from our website and input data,validate the return,create an upload file then upload from their profile

How can I register for eReturn?

How do I submit e-return forms?

How may I get access to the tax weaver certificate?

How do I file e returns for turn over tax?

How can I login to make returns for the first on internet?