Organisation : Kenya Revenue Authority (KRA)

Facility Name : Agent Checker

Country : Kenya

Website : https://itax.kra.go.ke/KRA-Portal/main.htm?actionCode=showOnlineServicesHomeLnclick#

How To Check KRA Agent Online?

To Check Kenya Revenue Authority (KRA) Agent Online, Follow the below steps

Related / Similar Facility : Kenya Revenue Authority Invoice Number Checker

Steps:

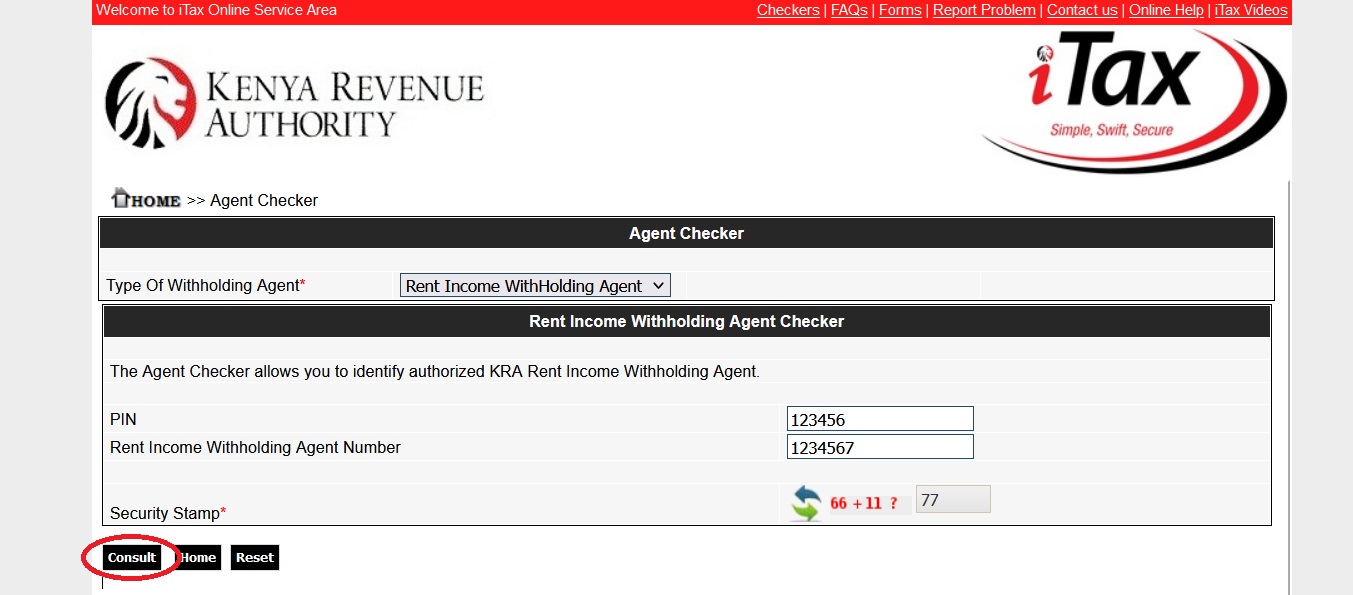

Rent Income Withholding Agent Checker:

Step-1 : Go to the link https://itax.kra.go.ke/KRA-Portal/pinChecker.htm?actionCode=loadWthPage&viewType=static

Step-2 : Select the option “Rent Income Withholding Agent Checker”

Step-3 : Enter the “PIN” and “Rent Income Withholding Agent Number” in the space provided.

Step-4 : Click On “Consult” Button.

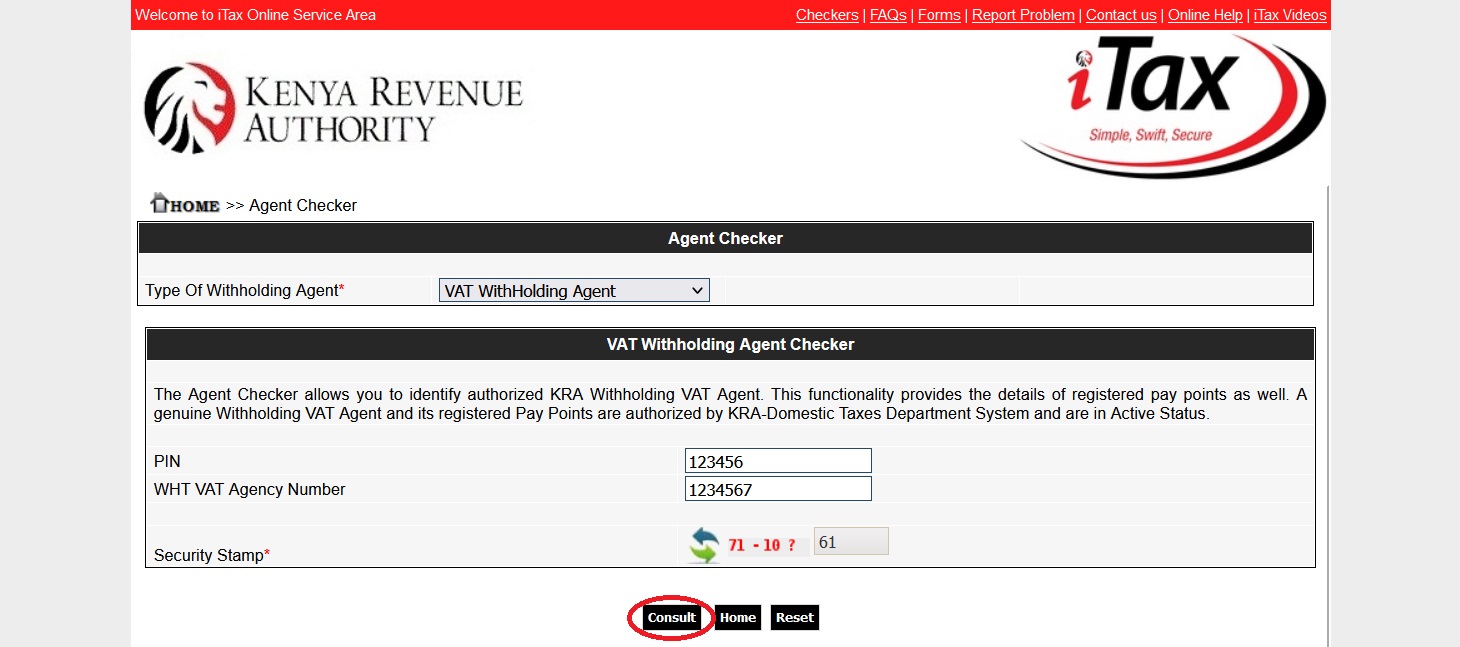

VAT Withholding Agent Checker:

The Agent Checker allows you to identify authorized KRA Withholding VAT Agent. This functionality provides the details of registered pay points as well. A genuine Withholding VAT Agent and its registered Pay Points are authorized by KRA-Domestic Taxes Department System and are in Active Status.

Step-1 : Go to the link https://itax.kra.go.ke/KRA-Portal/pinChecker.htm?actionCode=loadWthPage&viewType=static

Step-2 : Select the option “VAT Withholding Agent Checker”

Step-3 : Enter the “PIN” and “WHT VAT Agency Number” in the space provided.

Step-4 : Click On “Consult” Button.

FAQ On Kenya Revenue Authority (KRA)

Frequently Asked Questions FAQ On Kenya Revenue Authority (KRA)

What is a tax obligation?

A tax obligation is the liability of tax that one has.

What do I do after registering and can see only two icons(change password and logout)?

Normally a taxpayers profile will be fully populated will all icons within 24 hours upon registration. However a taxpayer intending to transact immediately can send this PIN to KRA through email Callcentre@kra.go.ke and DTDOnlineSupport@kra.go.ke or call 020 2390919 and 020 2391099 and 0771628105 or visit the nearest KRA office

Can I file all returns on iTax?

Yes you can. First you need to login into the system then go to the returns tab and select file return and download the return. You need to fill the return offline before you generate a zipped file that you will upload.

How do I treat Credits from a previous VAT return?

On the VAT return at the Tax Due worksheet, you can be able to put the figure at from the previous months credit.

If I dont have PINs for my suppliers what should I do?

Invoice without PIN is not valid tax invoice & therefore not allowed for tax deduction

How do I treat Credit notes in iTax?

iTax has provided for inclusion of the credit notes in the return. While filling the returns one needs to input a negative figure but quote the invoice relating to the credit note.

Can I correct an error once I file a return?

Yes. You can do this by filing an amended return.

I have heard that before one can complete the Excel Return one is required to enable MACROS on the excel sheet. What is enabling MACROS and how does one do this?

MACROS are inbuilt formulae in Excel that should be enabled once you download the return so that you can be able to fill in the details of the return. Enabling MACROS is on the read me section of the return and it gives you a step by step guide depending on the Excel version you have.

My business system produces a lot of data. With the Excel returns I will be required to fill every cell to input my data. This is cumbersome and time consuming. What will you do to facilitate and eliminate this inconvenience?

You can be able to do the returns in Excel and import the information to the return. You need to save this information in CSV (Comma delimited) for further information please contact KRA certified Intermediary agents, or call 020 2390919 and 020 2391099 and 0771628105.

I have a PIN but have not traded. Do I have to file returns?

Yes you need to file a NIL return. All you need to do is go to your iTax profile, Returns, and select the nil return option and submit.

Contact

Through email Callcentre@kra.go.ke and DTDOnlineSupport [AT] kra.go.ke or call 020 2390919 and 020 2391099 and 0771628105 or visit the nearest KRA office