Organization : Kenya Revenue Authority

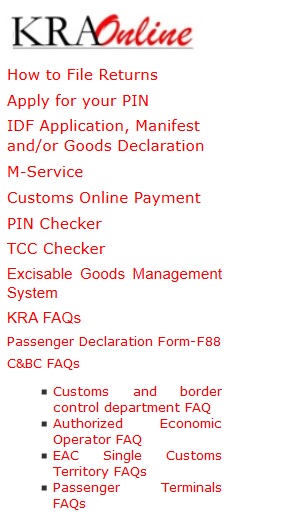

Type of Facility : Tax Compliance Certificate TCC Application

Country : Kenya

Website : http://www.kra.go.ke

KRA Tax Compliance Certificate Application

The following are the guidelines for application for a Tax Compliance Certificate (TCC).

Related / Similar Facility : KRA Kenya Invoice Number Checker

A Tax Compliance Certificate shall be issued to taxpayers who are compliant with the tax obligations as per the tax laws.

These obligations are :

** Filing of tax returns for the registered tax obligations

** Payment of the assessed taxes

** Declaring the correct income.

Procedure

The following procedures should be observed by the taxpayers seeking TCC.

** Application for a Tax Compliance Certificate shall be on the prescribed form “Tax Compliance Certificate Application Form” (Form TCC1). This can be downloaded from KRA website or obtained from the nearest Domestic Taxes Department Station.

** The completed TCC Application form should contain the correct Personal Identification Number (PIN). In case of limited liability companies and partnerships, the names and PIN of the Directors or Partners as the case may be, shall also be provided.

** The completed Application Form should be submitted to the KRA station where the applicant is registered for tax purposes. An applicant who may not be conversant with his/her domicile station should seek assistance from the nearest Domestic Taxes Department Station.

** The applicant shall ensure that all self assessment returns for tax obligations registered for are submitted and all outstanding tax liabilities settled. The same applies to directors or partners in case the applicant is a Limited Liability Company or Partnership.

** An application should be submitted at least thirty (30) days before the intended date of use.

** The TCCs are system generated and signed by the Station Manager, the Deputy Station Manager or the Compliance Programme Manager.

Download Form : https://www.statusin.org/uploads/7210-tax_compliance_certificate_application_form.pdf

Note:

The issuance of a Tax Compliance Certificate will not rule out an audit being carried out and any taxes found to be owing will be payable not withstanding the fact that a TCC has been issued.

FAQ On KRA Tax Compliance Certificate

How do I apply for TCC in iTax?

The taxpayer will apply for TCC through their iTax profile. The application will be received by a KRA officer and processed electronically. Successful applicants will receive email with the TCC attached. Unsuccessful applicants will be notified of the areas of non compliance.

What is iTax?

iTax is a system that has been developed by KRA to replace the current KRA Online system

How do I access iTax?

To log in to iTax , go to KRA website. On the website you will see the iTax portal banner. Click on it to access the iTax portal

How does iTax work?

iTax allows one to update their tax registration details, file tax returns using Microsoft Excel or Open Office, register all tax payments and make status enquiries with real-time monitoring of their ledger/account.

View Comments (2)

Can't I apply for the TCC online myself?