Organization : South African Revenue Service

Type of Facility : Tax Clearance Certificate TCC

Country: South Africa

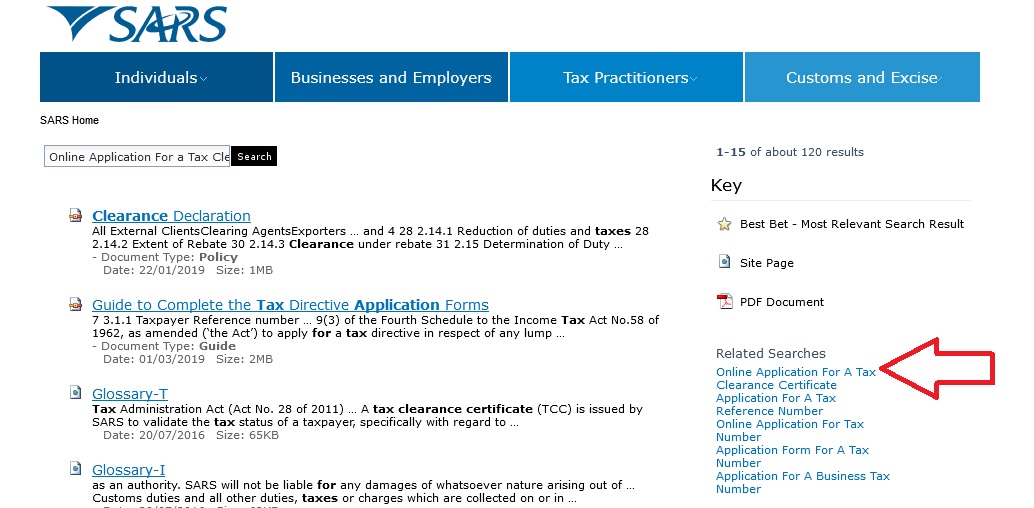

Website : http://www.sars.gov.za/ClientSegments/Individuals/Pages/default.aspx

eFiling: http://www.sarsefiling.co.za/

SARS Tax Clearance Certificate

What’s it for?:

You can apply for a Tax Clearance Certificate (TCC) to validate your status of a taxpayer. A TCC is issued free of charge and may be required for:

** Tenders – when applying for a tender or bid advertised

Related : South African Revenue Service Register As Tax Practitioner : www.statusin.org/4960.html

** Good standing – to confirm that the applicant is tax compliant

** Foreign investment allowance (FIA)

** Emigration.

What do I need to do?:

Depending on your requirements you will need to complete one of the following:

** IT 21 (a) – Application for a Tax Clearance Certificate in respect of citizens emigrating from South Africa

** TCC-001 – Application for a Tax Clearance Certificate in respect of Tenders & Good Standing

** FIA-001 – Tax Clearance Certificate i.r.o Foreign Investment Allowance for Individuals

A TCC will only be issued by SARS where the following requirements have been met:

The taxpayer must have registered for an Income Tax reference number prior to applying for a TCC.

** No outstanding debt for all taxes (including Secondary Tax on Companies (STC), Administrative Penalties and Employees’ Tax).

** Any deferred arrangements made are being adhered to.

** All returns and/or declarations must be up to date and in the process of being assessed by SARS.

** All tax reference numbers must be active and correct, e.g. the tax reference number must not be de-registered or suspended on the SARS system.

** The registration details on the TCC01 must correspond with the information on the SARS systems.

Top Tip:

A TCC is only valid for one year from the date of issue in respect of a tender and/or good standing, provided the taxpayer remains compliant with SARS requirements.

A taxpayer may apply for a TCC through one of the following channels:

** Completing the applicable application form and submitting it at the nearest SARS branch (a FIA or emigration TCC must be submitted at a SARS branch).

** Completing the applicable application form and submitting it to SARS by post or placing it in the SARS drop-box.

** Completing and submitting the application for a tender or good standing TCC via eFiling

Tax Clearance Certificate for Foreign Investment Allowance:

The document defines the procedure for the requests of a Tax Clearance Certificate (TCC) in respect of Foreign Investment Allowance (FIA).

This document applies to a South African citizen (individual) 18 years and older requesting a TCC at a SARS Branch Office / Compliance Centre (applications by post) and the collection thereof

TCC is used by SARS to certify that SARS has, after checking its records, found that the taxpayer named on the TCC is compliant has filed all required tax returns and has paid all taxes, penalties, and interest due as of the date the TCC is issued.

This certificate allows the third party to confirm the status of the applicant.

This is a secure facility and can only be accessed with the permission of the applicant who will supply the customer number and TCC number

View Comments (4)

I would like to get a copy of my tax certificate as on 29/02/2017.

Please could you help me to get my Tax Certificate for the period Feb 2016 to Feb 2017?

I would like a copy of my Tax Certificate as at 28022016.

I would like to get a copy of my tax certificate as on 28/02/2017.