Organization : Barbados Revenue Authority

Facility : Online/ Electronic Tax Administration System

Country: Barbados

Website : https://bra.gov.bb/

How To Login Into Barbados Electronic Tax Administration System?

In the Barbados Revenue Authority we care about taxpayer’s needs. We therefore invite you to use our new information system which provides fast, efficient and user friendly services.

Related : Inland Revenue Department Tax Refund Certificate : www.statusin.org/7264.html

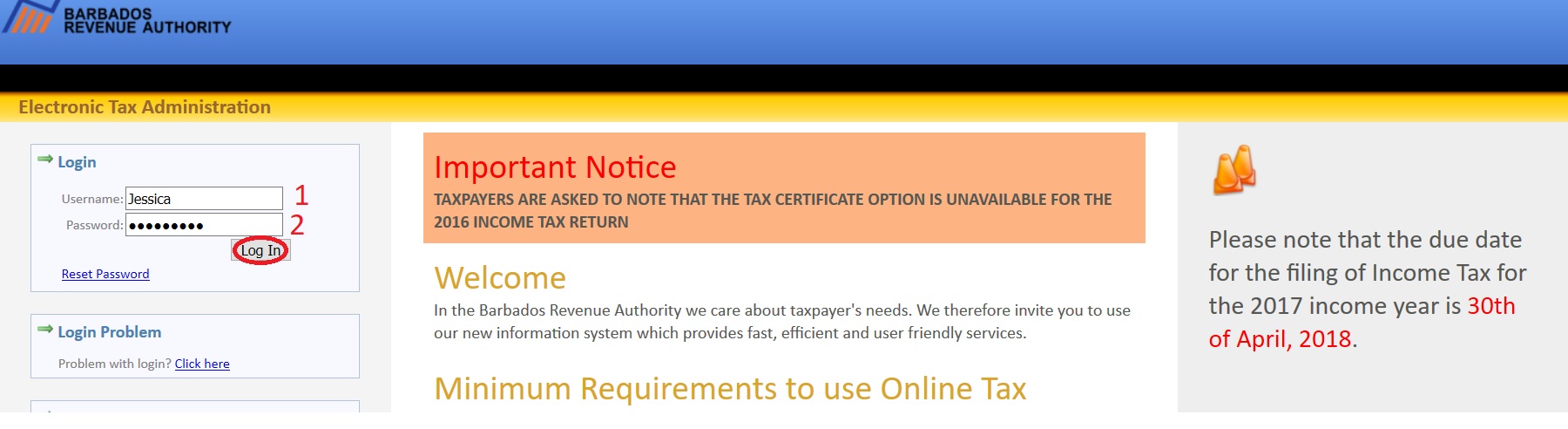

Go to the Electronic Tax Administration website of Barbados Revenue Authority link provided above. You are required to login with your details to file income tax.

Step 1 : Enter your Username

Step 2 : Enter your Password

Step 3 : Click Login Button

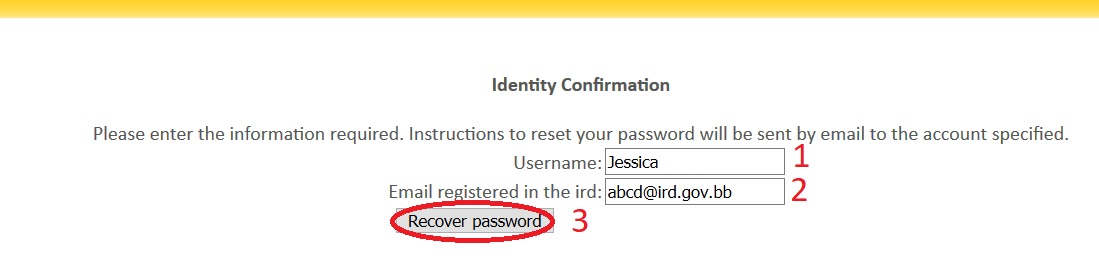

Reset Password :

You can reset your password by clicking the link provided below the login section. Please enter the information required. Instructions to reset your password will be sent by email to the account specified.

Step 1 : Enter your Username:

Step 2 : Enter your Email registered in the ird

Step 3 : Click Recover Password Button

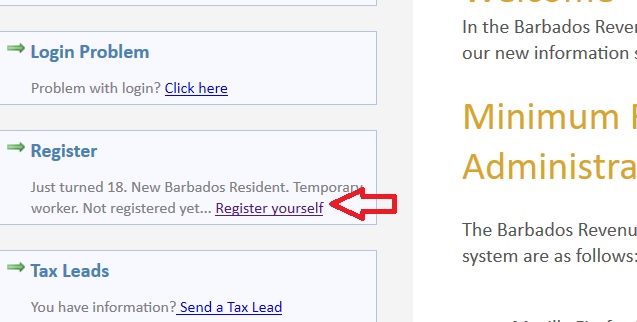

How To Register For IRD Online Services?

Just turned 18. New Barbados Resident. Temporary worker. Not registered yet.. Just register yourself by clicking register link.

Welcome to IRD Secure Access system

This step by step process allows you to get a username and password . Please click on the NEXT button to continue.

Step 1 : Enter your National Registration Number (NRN. Only numbers, without dashes)

Step 2 : Enter your Date of birth (yyyy-mm-dd)

Step 3 : Enter your First name (as registered in the electoral office)

Step 4 : Enter your Last name (as registered in the electoral office)

Step 5 : Enter your Email

Step 6 : Click Next Button

If you provide any wrong information it will show as “Information does not match electoral office information”.

How To Send a Tax Lead?

If You have information, then send a tax lead here. Click the available link to send it.

Taxpayer & Personal Information need to be filled out.

Taxpayer Information :

Step 1 : Enter your Name of Company/Individual

Step 2 : Enter your TIN (If known)

Step 3 : Enter your Address (If known)

Please write in as much detail as possible, the nature of the Income Tax / Corporate Tax issue/problem regarding this person or company.

Step 4 : Enter Nature of Business

Personal Information :

Step 5 : Select Please contact me

Step 6 : Click Send Button

NOTE: You will not be contacted unless the above box is checked.

Minimum Requirements

The Barbados Revenue Authority wishes to advise that the minimum requirements to use this system are as follows:

** Mozilla Firefox 2.0 or greater or Microsoft Internet Explorer 8.0 or greater (you can get it here)

** Adobe acrobat 8.0 or greater )

It is important to note that all those programs are free to download and constitute widely used standards that you will be able to use with most web sites. If you don’t meet the requirements, most of the functionality, including the calculation of income tax returns will be unavailable.

FAQ On Barbados Electronic Tax Administration System

Here are some FAQ on Barbados Electronic Tax Administration System (TAMIS):

What is TAMIS?

TAMIS is a web-based system that allows taxpayers in Barbados to file their tax returns, make payments, and access tax information online. The system was launched in 2013 and has since been used by over 100,000 taxpayers.

What are the benefits of using TAMIS?

There are a number of benefits to using TAMIS, including:

** Convenience: TAMIS allows taxpayers to file their tax returns and make payments online, which is more convenient than having to visit the Barbados Revenue Authority (BRA) office in person.

** Speed: TAMIS allows taxpayers to file their tax returns and make payments quickly and easily.

** Accuracy: TAMIS helps to ensure that taxpayers file their tax returns accurately.

** Security: TAMIS is a secure system that protects taxpayers’ personal information.

Who can use TAMIS?

Any taxpayer who is registered with the BRA can use TAMIS. To register for TAMIS, you will need to visit the BRA website and create an account.

View Comments (9)

I am trying to file my 2016 return but can't do it online. Please help me.

I have filed for 2014 and 2015 & haven't received anything as yet. Now I can't seem to file for 2016. Please help me even if it means I have to come to the office.

Why is it taking so long for the returns to be sent out? Please help me.

I am trying to file my taxes and I cannot do it online. Please help me.

I put in the etax.ird.gov.bb and still can't get it the system.

I have filed twice in the month of April 2016. Can someone please tell me what is going on with my return since I am unable to find my account?

I was waiting for my employer to give me my slip for tax return but was informed by someone it is not done. So at this time I must file ob line myself. How is this process done?

What is the NRN? Where do I get this number from?

Thank you!

Your NRN (National Registration Number) is your Barbados I.D. Number which you get from the Electoral and Boundaries Commission in the Old NIS Building in town opposite the Transport Board Bus Terminal by River Road, Bridgetown.