jamaicatax.gov.jm Apply for an eService Account : Tax Administration Jamaica

Organization : Tax Administration Jamaica

Facility : Apply for an eService Account

Country : Jamaica

Website : https://www.jamaicatax.gov.jm/web/guest/home

Terms & Conditions : https://www.statusin.org/uploads/30051-eServices.pdf

| Want to comment on this post? Go to bottom of this page. |

|---|

Jamaica Tax Apply eService Account

Tax Administration Jamaica continues to change the way it does business through its value added services that are convenient, secure, and fast.

Related : Tax Administration Jamaica Submit Zero Rating Request Online : www.statusin.org/30059.html

To this end, the Revenue Administration Information System (RAiS) is now in the second phase of its implementation. This means that taxpayers will be able to do much more with our web service offerings, which will greatly improve the way taxpayers interact with us.

It also means how you view and use the web services we now offer, will be different from what you have been accustomed to.

Taxpayers wishing to conduct business via e‐Services, such as making a payment, filing a return or making an inquiry MUST be in registered for a TAJ e‐Services account.

Note however, that Taxpayers must be in possession of a logon to the TAJ Web Portal before they can apply for an e‐Services account.

How To Submit

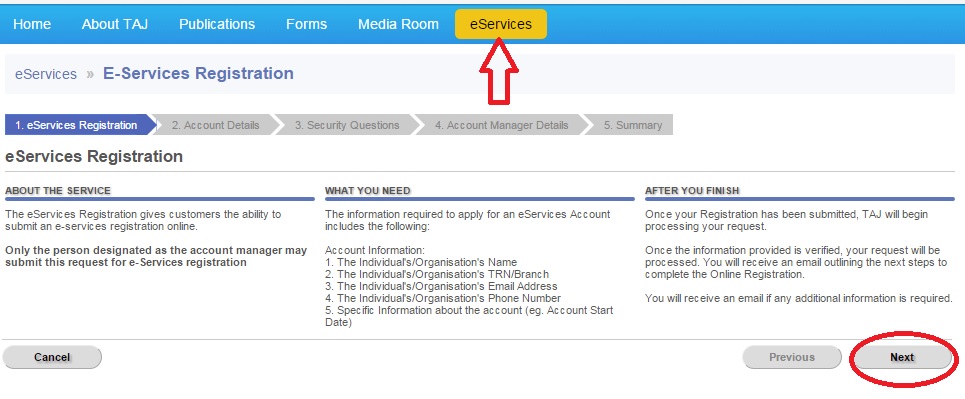

To apply for an e-Services Account online, visit the TAJ Website and log in to the TAJ Web Portal, then select the “Apply for an e-Services Account”hyperlink from the e‐Services home page.

A default “Instructions” page giving basic information about the service, what will be needed, and what to expect at the end of the process is displayed,

** Select the button “Next”. The Account Details page is displayed.

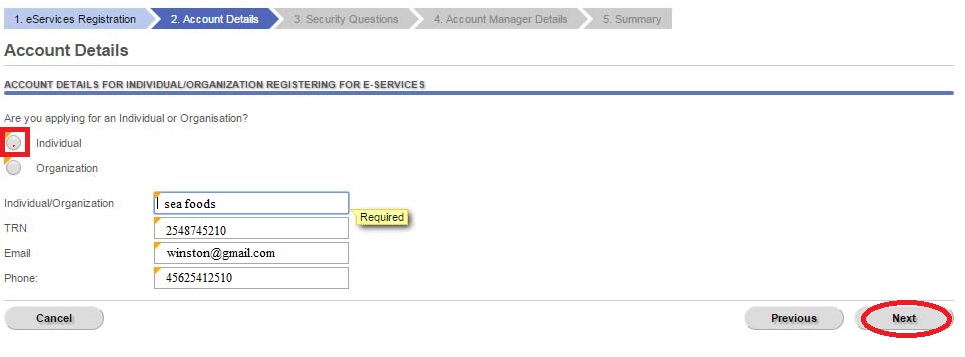

** Select the “Individual” or “Organization” radio button, and enter the required information.

Note : Mandatory fields are indicated by the word “Required” and a yellow triangle in the top left corner of the field.

** Select “Next” to move to the Security Questions page.

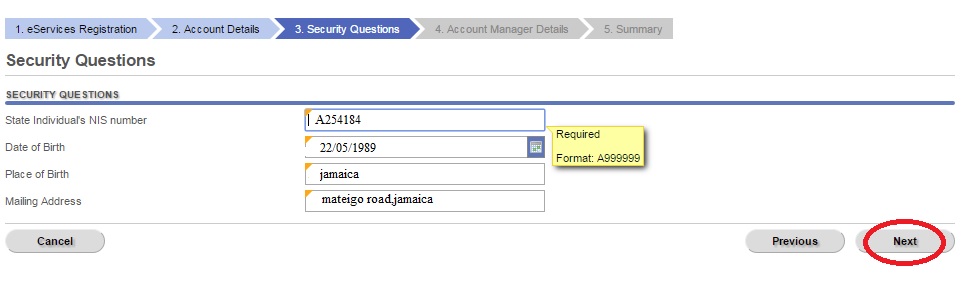

** Answer all security questions and click “Next” to move to the Account Manager Details page.

Note : The security questions for Individuals are different from those of Organizations, and are randomly generated.

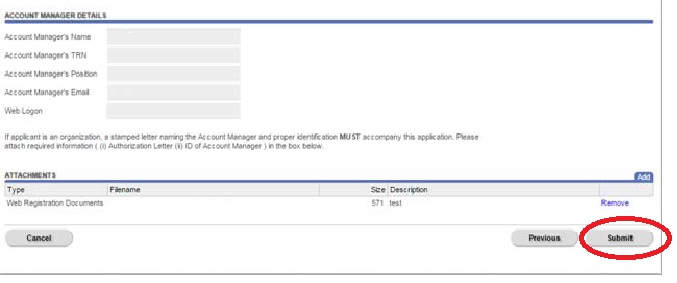

** Complete details relating to the Account Manager and upload the required attachments by selecting the “Add” button. The size of attachments here are limited to 5MB per file.

** You will be required to state whether or not other users are to be added to the Account by selecting the appropriate radio button.

** If “Yes” is selected, add the required details for the other person by selecting the “Add a Record” hyperlink. Records are added individually, therefore you will need to select “Add a Record” for each record you would like to add.

** Select “Next”. Review the information on the Summary page displayed below

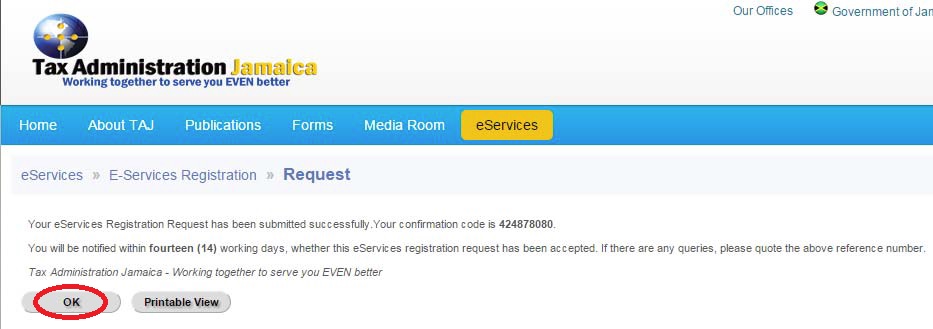

** Click the “Submit” button. A confirmation page will be displayed, as shown below

Note : The button “Previous” is used to return to a previous page. Select button as often as needed to return to the desired page.

** Select “OK” to return to the e‐Services page, or “Printable View” to print the Confirmation message.

Note : Ensure that the confirmation number is recorded before selecting the “OK” button

General Information :

Note : The button “Previous” is used to return to a previous page. Select button as often as needed to return to the desired page. To leave the current page or abort the current process, select the button “Cancel”.

FAQ

What is my duty-free allowance when I return from a trip abroad?

Each Jamaican resident 18 years old and over is allowed US$500 worth of personal and household effects exempt from duty, once every 6 months.

What’s the difference between contract of services and contract for services?

Contract of services refers to an employed person while Contract for service refers to self-employed individuals.

I am a pensioner where do I apply for Income Tax exemptions?

Apply to Tax Administration Jamaica; Refunds Unit – 116 East Street Kingston.

A person who is a Canadian resident earned interest in Jamaica. At what rate should this be taxed?

The person will be taxed at the double taxation rate of 15% providing prior approval was given by the TAAD.