Request an Advisory Visit Tax Administration Jamaica : jamaicatax.gov.jm

Organization : Tax Administration Jamaica

Facility : Request an Advisory Visit

Country : Jamaica

Website : https://www.jamaicatax.gov.jm/web/guest/home

Terms & Conditions : https://www.statusin.org/uploads/30076-AdvisoryVisit.pdf

| Want to comment on this post? Go to bottom of this page. |

|---|

Jamaica Tax Request Advisory Visit

Tax Administration Jamaica continues to change the way it does business through its value added services that are convenient, secure, and fast. To this end, the Revenue Administration Information System (RAiS) is now in the second phase of its implementation.

Related : Validate Zero Rating Approval Letter Tax Administration Jamaica : www.statusin.org/30070.html

This means that taxpayers will be able to do much more with our web service offerings, which will greatly improve the way taxpayers interact with us.

Taxpayers can now submit an online request for a representative of Tax Administration Jamaica to conduct a site visit to discuss topics such as GCT registration, tax laws, return preparation, revenue measures, among other things, via the “Advisory Visit Request” option.

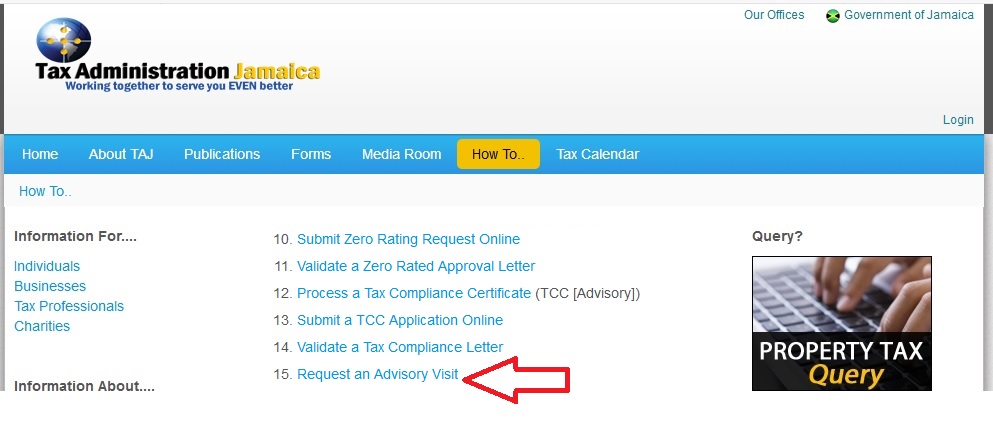

In order to make such a request, the taxpayer can visit the TAJ Website and log in to the TAJ Web Portal, select the “Advisory Visit Request” hyperlink

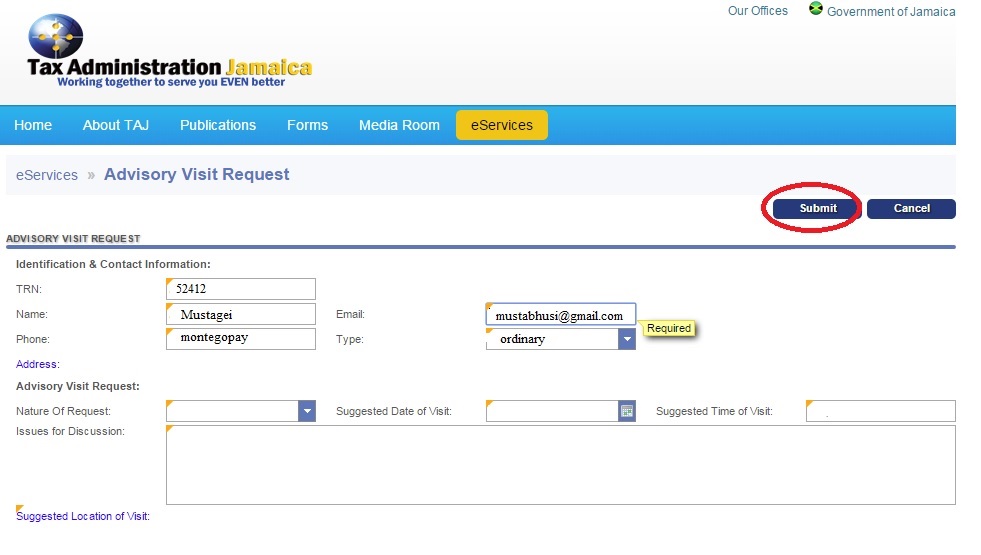

** Enter valid information in the fields provided.

** Select the “Address” hyperlink to enter your address. The entry of this information is not mandatory.

** Select the “Suggested Location of Visit” to enter the desired location of the visit.

Note : Mandatory fields are indicated by the word “Required” and a yellow triangle in the top left corner of the field.

** Once all required fields have been filled, select the “Submit” button to proceed to the confirmation screen as shown below.

** The “Cancel” button is used to abort the process.

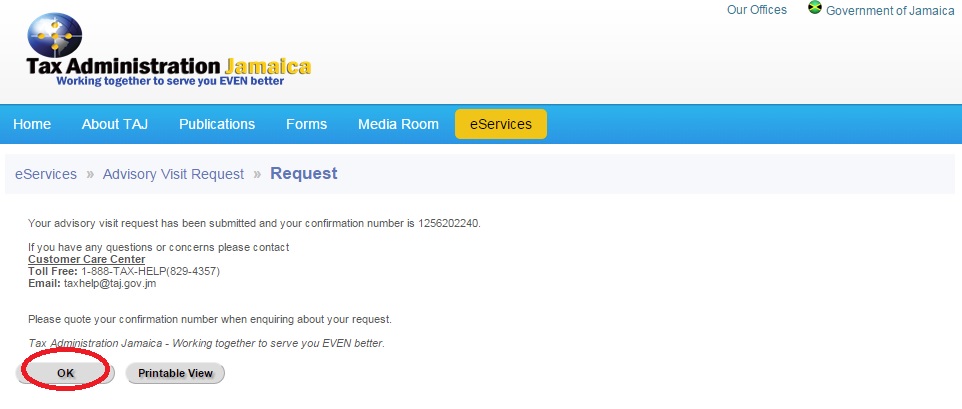

** Select “OK” to return to the e‐Services page, or “Printable View” to print the Confirmation message.

Note : Ensure that the confirmation number is recorded before selecting the “OK” button

About Us

Tax Administration Jamaica (TAJ) proudly operates as the country’s premiere revenue collecting agency.

In keeping with our mission, our primary goal is to foster voluntary compliance, collect the revenue due in an equitable and efficient manner, contribute to a competitive business environment and facilitate economic growth and development.

Through excellent service by our highly skilled staff, and in capitalising on the strengths of the organisation, our primary focus, as we strive to accomplish the broad goals and objectives set out by the Ministry of Finance and Planning and in general the people of Jamaica is one that embodies the mantra, “Working together to serve you Even better”

FAQs

1. How do I calculate my income tax?

Gross Salary less National Insurance Contributions (NIS), approved superannuation contribution and the tax-free income (threshold) for the period of payment multiplied by 25%.

The tax-free income is outlined as follows : If you are paid: weekly- $8,484, fortnightly $16,968 and monthly $36,764.

2. What are the payroll taxes and statutory deductions?

PAYE (Income Tax) -25%. Education Tax 2% employees, 3% employers NHT- 2% employees, 3% employer NIS – 2½% employees, employer 2½% (salary ceiling – $1,000,000).

3. Where do I locate the forms to download?

Click on the forms link from the homepage.

4. On what basis can one make a claim for Income Tax refunds?

** If tax has been overpaid

** If the employee was off on scholarship and tax was deducted

** if the person becomes unemployed and did not utilize the full tax free income for the year

** If a person qualifies for exemptions and this was not applied in calculating the tax.

5. What are the capital allowance rates for a trade vehicle?

12½% initial and 12½% annual allowances. Note that this is calculated on the straight line basis and the annual allowance is pro-rated in the year of purchase.