pdic.gov.ph How To File Claim For Deposit Insurance : The Philippine Corporation

Name of the Organization : The Philippine Deposit Insurance Corporation (pdic.gov.ph)

Type of Facility : How To File Claim For Deposit Insurance

Location : Makati

| Want to comment on this post? Go to bottom of this page. |

|---|

Website : http://www.pdic.gov.ph/index.php?nid1=5

PDIC How To File Claim For Deposit Insurance

Depositors Not Required To File Deposit Insurance Claims :

Depositors

(i) with validated deposit balances of P50,000.00 and below,

(ii) with complete mailing address found in the bank records or updated through the Mailing Address Update Form (MAUF), and

Related : Government Service Insurance System Philippines eCard Plus Replacement : www.statusin.org/7132.html

(iii) without any outstanding obligation with the bank do not need to file a claim.

They are automatically paid through postal money orders (PMOs) or checks to be sent directly to the depositors’ addresses via registered mail or courier services.

Depositors may expect delivery of checks for their deposit insurance claims with account balances of P50,000 and below within 3 weeks from the closure of a bank.

Depositors who are unable to receive payment for their deposit insurance through PMO or checks must contact the PDIC Public Assistance Department at telephone numbers (02) 841-4630 to 31, or e-mail at pad AT pdic.gov.ph.

Depositors outside Metro Manila may call the PDIC Toll Free Hotline at 1-800-1-888-PDIC (7342).

A. Who Should File Deposit Insurance Claims :

Depositors with validated deposit balances of more than P50,000.00, and those with (i) outstanding obligations with the bank, and/or (ii) have incomplete mailing addresses, need to file a claim for deposit insurance at the designated site of the claims settlement operations.

How To File Claims

Claims may be filed either:

Personally

** At the premises of the closed bank where the deposit account was maintained or at a designated site during the period of Claims Settlement Operations (CSO), as announced in the Notice of Depositors posted at the bank’s premises or as published in a newspaper of general circulation or on the PDIC website, or

** At the PDIC Claims Counter located at the 4th Flr., PDIC Ayala Extension Office, SSS Building, corner V.A. Rufino St., (formerly Herrera St.), Makati City.

Through mail – to be sent to the following address :

Claims Processing Department

Philippine Deposit Insurance Corporation

4th Floor SSS Building

6782 Ayala Avenue cor. V.A Rufino St.

1226 Makati City, Philippines

Note: Filing of claims for deposit insurance will prescribe at the end of two (2) years from actual takeover of the closed bank by PDIC.

C. Steps In Filing Claims :

Secure a Claim Form from any authorized PDIC representative. The Claim Form can also be downloaded from the PDIC website.

Important Notice: Please report to PDIC any information for the sale of the Claim Form.

Fill up all the entries in the Claim Form and sign the “Signature of Depositor/Claimant over Printed Name”. Ensure that the signature in the Claim Form tallies with the signature of the depositor appearing in the bank records and the documents to be submitted to PDIC.

** Signatures of depositor on the Claim Form should be similar to the valid IDs to be presented.

** For minor depositor (below eighteen [18] years old), parent should sign the Claim Form.

** For By or ITF accounts, the agent can sign the Claim Form.

For joint accounts: “OR, AND/OR, AND”, each depositor in the joint account should accomplish separate Claim Forms.

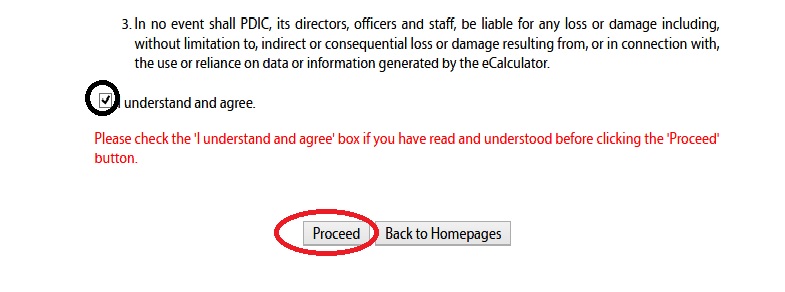

Deposit Insurance eCalculator

Welcome to the Deposit Insurance eCalculator, an interactive tool that helps estimate your insured deposits in member-banks of PDIC. The result generated by the eCalculator is just an estimate of your insured deposit and may not be saved when you exit the eCalculator.

Submit the duly accomplished Claim Form, together with the following documents :

** Original evidence of deposit such as savings passbook, certificate of time deposit, latest bank statement including unused checks and ATM card. For joint accounts: “OR, AND/OR, AND”, the evidence of deposit should be photocopied as many copies as there are depositors to the account.

** Original copy of TWO (2) VALID PHOTO-BEARING IDENTIFICATION DOCUMENTS (IDs) with clear signature of depositor/claimant such as Driver’s License, SSS/ GSIS ID, Senior Citizen’s ID, Passport, PRC ID, OWWA/ OFW ID, Seaman’s ID, Alien Certification of Registration ID, Voter’s ID, IBP. Please ensure that the ID number is clear and legible.

** Original copy of the Birth Certificate from the National Statistics Office (NSO) or duly certified copy from the local civil registrar, for depositors below eighteen (18) years old.

For depositors who choose to file their claims through mail the same set of document requirements must be submitted.

PDIC will not accept claims which are incomplete/lacking in requirements.

If the depositor is unable to file by himself, a representative may file in his behalf provided the representative will submit a duly notarized Special Power of Attorney (SPA). If the SPA is executed abroad, it must be duly authenticated by the Philippine Consul near the depositor’s residence.

D. Processing Of Claims :

PDIC will evaluate claim for validated accounts based on original evidence of deposits submitted, signature card, identification documents and other pertinent bank records.

If all documents and additional requirements, if any, are complete, payment of deposit insurance will be released immediately.

For claims with incomplete requirements, and mode of filing is any of the following:

** Personal filing – a Claim Status Sheet will be issued by PDIC to acknowledge receipt of documents submitted, and to inform of the status of the claim and/or additional requirements needed to complete its processing.

** Filing through mail – a letter-notice of the status/requirements of the claim will be sent by PDIC, if additional documents will be required.

E. How To Follow Up The Status Of Claims :

You or your duly designated representative may follow up your pending claim through:

Telephone inquiry by calling the PDIC Hotlines at 841-4630 to 4631 or toll free at 1-800-1-888-7342 or 1-800-1-888-PDIC.

Email at pad AT pdic.gov.ph or written communication addressed to:

Public Assistance Department

Philippine Deposit Insurance Corporation

10th Floor, SSS Building

6782 Ayala Avenue cor. V.A Rufino St.

1226 Makati City, Philippines

Inquiry in person at the premises of the closed bank, or at the designated site during CSO period or at the PAD Counter located at the 4th Flr., PDIC Ayala Extension Office, SSS Building, corner V.A. Rufino St., (formerly Herrera St.), Makati City.

When inquiring by telephone or letter, ensure that the following reference information are mentioned

name of the closed bank;

name of the depositor, and

claim number and/or account number.

Contact us

Philippine Deposit Insurance Corporation

4th – 10th Floor SSS Building

6782 Ayala Avenue corner V.A. Rufino St.

(formerly Herrera Street)

Makati City 1226 Philippines

Sir/Mam, What are the requirements in updating my regular savings coz i started to work in PNP CORDILLERA 2005 December 16.but just get my regular salary in september 2006, so the other months in my salary (8 months and 15 days)were vouchered which

What are the requirements in updating my regular savings coz i started to work in 2005 December 16.but just get my regular salary in september 2006, so the other months in my salary (8 months and 15 days) were vouchered which

What are the requirements if the depositors is a cooperative, cooperative banks, organization etc?