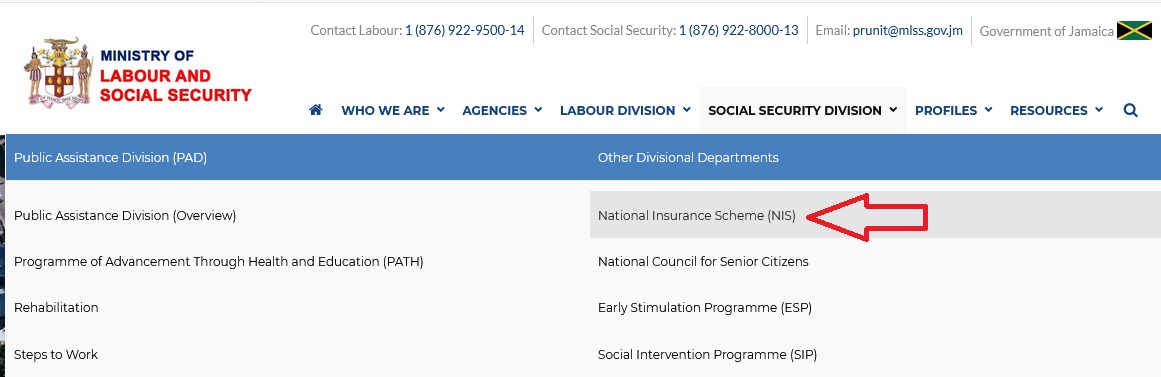

mlss.gov.jm National Insurance Scheme (NIS) Registration Jamaica : Ministry of Labour and Social Security

Name of the Organization : Ministry of Labour and Social Security

Type of Facility : National Insurance Scheme (NIS) Registration

Country : Jamaica

Official Website : https://www.mlss.gov.jm/

| Want to comment on this post? Go to bottom of this page. |

|---|

MLSS National Insurance Scheme Registration

NIS is a compulsory contributory funded social security scheme, which offers financial protection to the worker and his family against loss of income arising from injury on job, incapacity, retirement, and death of the insured.

Related / Similar Service : MOH Jamaica Apply For Covid-19 Vaccinations

The benefits are :

** Retirement

** Widows’/Widowers’

** Invalidity

** Special Child

** Orphan

** Employment Injury Benefits

** Anniversary Pensioners

** Funeral Grant

** NI Gold Health Plan

Who is covered :

** Employed

** Self Employed

** Voluntary Contributors

Employed Persons

Employed persons are those who work in a business, not their own. This category includes factory workers; private household workers such as butlers, chauffeurs, cooks, gardeners, general helpers, housekeepers and nurse-maids; and all other employed persons including civil servants, teachers, nurses and members of the security forces.

Self Employed Persons

Self employed persons are those who work independently in their own business. Included in this category are doctors, lawyers, accountants, consultants, vendors, Informal Commercial Importers, dressmakers, tailors, hairdressers, barbers, fisher folk, farmers and Jamaican nationals employed in foreign embassies in Jamaica.

A total contribution of 5% of gross salary (up to the maximum insurable wage ceiling defined by the NIS) is to be remitted annually using the stamp card and income tax return.

Voluntary Contributors

These are persons who do not contribute as employed or self employed and/or are no longer liable to contribute because

(i) they have retired from full time employment before reaching the retirement age,

(ii) they have relocated to another country (with which Jamaica does not have a Reciprocal Social Security Agreement) for an indefinite period, and

(iii) they have become unemployed.

They however wish to continue contributing to the NIS. Approval must be sought through (a) the completion of the Voluntary Contributor Application Form and (b) its submission to the nearest Parish Office.

Registration

Under the National Insurance Act, every person on attaining age 18 years is required to be registered under the National Insurance Scheme. The Ministry maintains a permanent record for each person registered under the Scheme.

This is called a Life Record and comprises :

** The insured’s National Insurance number.

** The insured’s name

** The employer(s) name and reference number(s)

** The number of weeks worked

** The joint employee/employer contributions

Note :

The National Insurance number is the means by which the Ministry identifies each contributor. Failure to register, registering more than once or registering with an incorrect name and incorrect year of birth could result in the loss of benefit or a portion thereof.

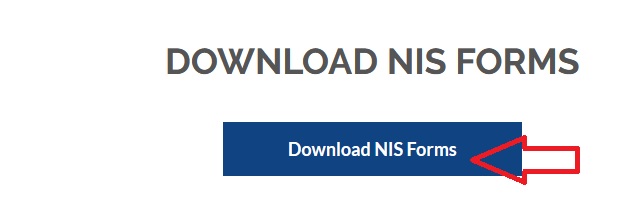

Download Form : https://www.mlss.gov.jm/

FAQs

Who is eligible for retirement benefit?

A person who has reached retirement age that is

** a man who is 65 years and over

** a woman who is aged 60 or over and who in either case has made the required National Insurance contributions and has ceased gainful employment permanently.

What happens if on reaching the above mentioned retirement age individuals do not retire but continue working?

They will continue to pay National Insurance while they remain in gainful employment until aged 65 (woman) or 70 (man).

What is difference between a pension and a grant?

A pension is payable for life and the pensioner receives fortnightly payments, while a grant is a lump-sum in one payment only.

Apart from age, what other qualifying conditions are there?

There is also a contribution qualification to be satisfied. To qualify for a pension one must have paid a minimum of 156 weekly payments with an average of at least 13. When contributions are inadequate for a pension, a grant may be awarded provided the contributor had made a minimum 52 weekly contributions.

Does a widow /widower receive any special consideration when he/she claims retirement benefit?

Yes. A widow/widower who has made at lest 156 contributions but whose contributions would not be adequate to enable her/him to receive a pension may substitute her husbands /his wifes contribution for her/his provided such contributions were paid during the period of their marriage or three years (or more) union .

This arrangement assists her/him in satisfying the contribution requirement for retirement pension

Will the NIS contribution increase to 6% this month?

Let me know, how long does funeral grant take to pay out?