cpf.gov.sg Retirement Sum Topping-Up Scheme Singapore : Central Provident Fund

Organization : Central Provident Fund Board

Facility : Retirement Sum Topping-Up Scheme

Country : Singapore

Website : https://www.cpf.gov.sg/member

| Want to comment on this post? Go to bottom of this page. |

|---|

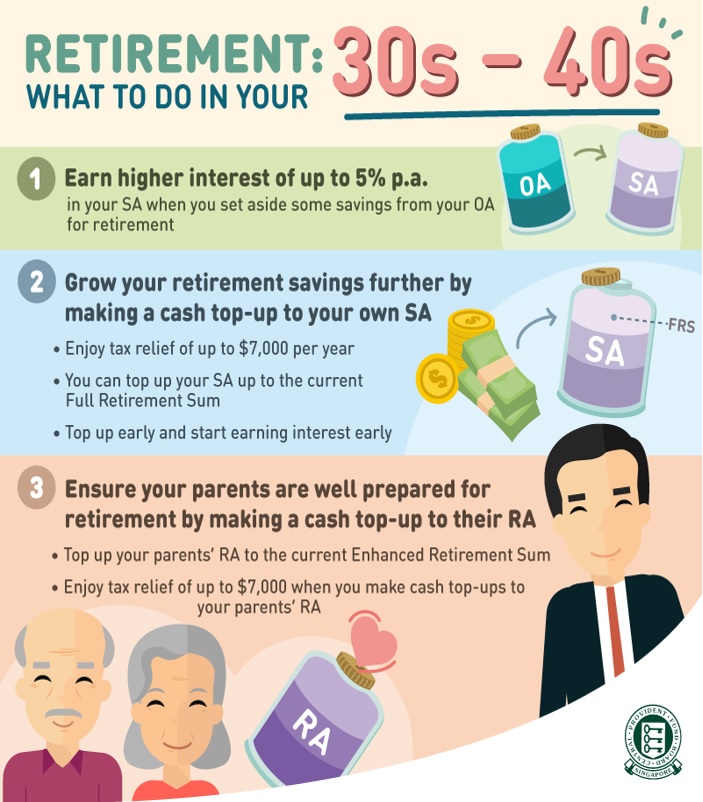

CPF Retirement Sum Topping-Up Scheme

The Retirement Sum Topping-Up Scheme (RSTU) helps to build up your retirement savings. You can also help your loved ones grow their retirement savings through RSTU.

Related / Similar Scheme : CPF CAYE Scheme

You can do the following

** Top up with cash or transfer of your CPF savings

** Top up your own or your loved ones’ Special Accounts (below age 55) or Retirement Accounts (age 55 and above)

Objective

The Retirement Sum Topping-Up (RSTU) Scheme helps you build up your own or your loved ones’ retirement savings through higher monthly payouts and/or extended payout duration.

You can top up via CPF transfer or cash to your own and/or your loved ones’ Special Accounts (SA) (for recipients below age 55) up to the current Full Retirement Sum (FRS), or Retirement Accounts (RA) (for recipients aged 55 and above), up to the current Enhanced Retirement Sum (ERS).

CPF Transfers :

You can make CPF transfers to yourself, your spouse, parents, parents-in-law, grandparents, grandparents-in-law and siblings.

You will not be able to transfer your CPF savings to your children.

Cash top-ups :

Cash top-ups can be made to any recipient. You can enjoy tax relief of up to $7,000 per calendar year if you are topping up for yourself and additional tax relief of up to $7,000 per calendar year if you are topping up for your parents, parents-in-law, grandparents, grandparents-in-law, spouse and siblings.

How to Apply?

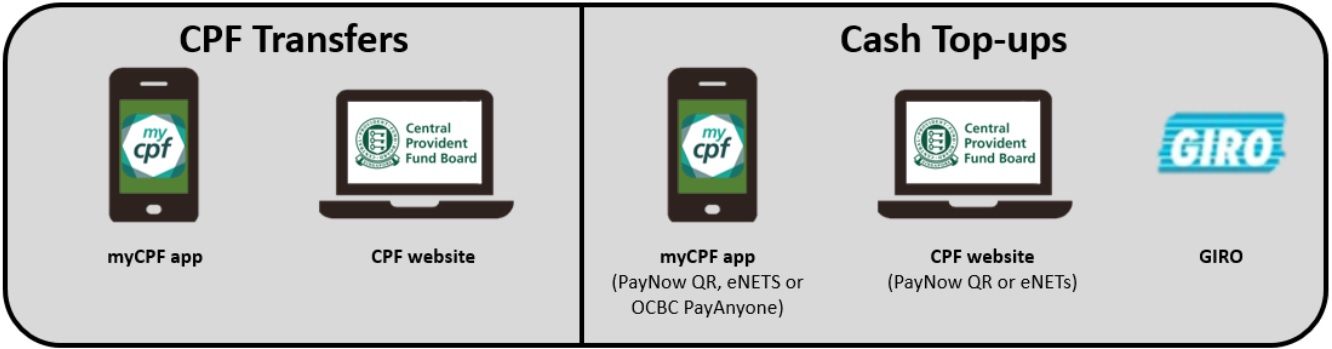

CPF Transfers

(i) myCPF Mobile app

** Tap on “myCPF” app on your mobile device.

** Login using your SingPass.

** Tap on the menu icon on the top left hand corner.

** Tap on “My Services” -> “Special/Retirement Account Top-Up”.

** Submit your application.

(ii) my CPF Online Services on CPF website

** Login with your SingPass.

** Click on My Requests -> Building Up My / My Recipient’s CPF Savings.

Cash Top-ups

(i) myCPF Mobile app :

** Tap on “myCPF” app on your mobile device.

** Login with your SingPass.

** Tap on the menu icon on the top left hand corner.

** Tap on “My Services” -> “Special/Retirement Account Top-Up”.

** Submit your application and make your payment immediately via:

i. PayNow QR (upload the QR code generated into your bank’s mobile app); or

ii. OCBC Pay Anyone app; or

iii. eNETS Debit.

(ii) PayNow QR or eNETS Debit via e-Cashier on CPF website :

** Go to e-Cashier and submit your application.

** Select your payment mode and make your payment immediately via:

a. Scanning the QR code generated with your bank’s mobile app; or

b. eNETS Debit.

(iii) GIRO :

** Use our GIRO facility to make monthly and/or yearly cash top-ups to your own or loved ones’ CPF accounts.

** Download and complete the latest* Top Up Retirement Sum Using GIRO (PDF, 0.4MB).

Mail it to :

CPF Board

Robinson Road P.O. Box 3060 Singapore 905060

Upon approval of your GIRO application, your GIRO deduction will commence in the following month. The deduction will take place on the 15th of each month. If the 15th falls on a Saturday, Sunday or public holiday, the deduction will be made on the next working day.

* Submitting the latest version of the form ensures that the necessary details are provided which will help facilitate the application process.

Supporting Documents

For CPF transfers :

Please login to make a CPF transfer to your own/your recipient’s CPF account. Login > My Requests > Building Up My / My Recipient’s CPF savings.

For first-time transfer of your CPF savings, you will need to submit the following documents to prove your relationship with the recipient.

** your marriage certificate for transfer to spouse, if your marriage is registered overseas;

** your birth certificate for transfer to parent(s);

** your and your parent(s)’s birth certificates for transfer to grandparent(s)

** your and your sibling(s)’s birth certificates for transfer to sibling(s);

** your overseas marriage certificate* and your spouse’s birth certificate for transfer to parent(s)-in-law; and/or

** your overseas marriage certificate*, your spouse’s and your spouse’s parent(s)’s birth certificates for transfer to grandparent(s)-in-law

* Not required if your marriage is registered in Singapore

If you have previously made a CPF transfer to your recipient, you are not required to submit the supporting documents again to make another CPF transfer to the same recipient.

You can submit the documents to us via My Mailbox

Step 1 : Login to cpf.gov.sg with your SingPass

Step 2 : Click on “Online Services Menu”

Step 3 : Click on “My Mailbox”

Step 4 : Click “+New Enquiry” to begin

Step 5 : Under Subject, select “Retirement / Aged 55 and Above / Top-ups”

Step 6 : Under Category, select “General Enquiry – Retirement”

Step 7 : Attach your documents and key in your request in the Message field

Step 8 : Click Submit to submit your enquiry

For Cash Top-ups :

No supporting documents are required for making top-ups using cash.

FAQs

1. If my recipient passes away, will my top-ups be refunded to me?

Whether the top-ups will be refunded depends on when the cash top-up/CPF transfer was made.

2. If I have the Full Retirement Sum and do not wish to top up to the Enhanced Retirement Sum now, can I just top up as and when I have the money?

For higher payouts, you can top up your Retirement Account up to the Enhanced Retirement Sum, which is three times of the current Basic Retirement Sum. You need not top up the amount in a single transaction and can choose to make the top-ups at any time.

3. Is there any age limit for receiving top-ups?

There is no age limit for receiving top-ups. Recipients below age 55 will receive top-ups to their Special Account, while recipients age 55 and above will receive top-ups to their Retirement Account.

4. Can I still top up my Retirement Account after receiving payouts?

If you have reached your Payout Eligibility Age (PEA), you can still top up to your Retirement Account even after receiving your payouts, so long as you have not set aside the current Enhanced Retirement Sum.