vrl.lta.gov.sg Renew Road Tax Singapore : Land Transport Authority

Organisation : Land Transport Authority of Singapore

Facility Name : Renew Road Tax

Country : Singapore

Website : https://vrl.lta.gov.sg/lta/vrl/action/pubfunc?ID=RoadTaxEnquiry

| Want to comment on this post? Go to bottom of this page. |

|---|

How to Renew Road Tax Singapore?

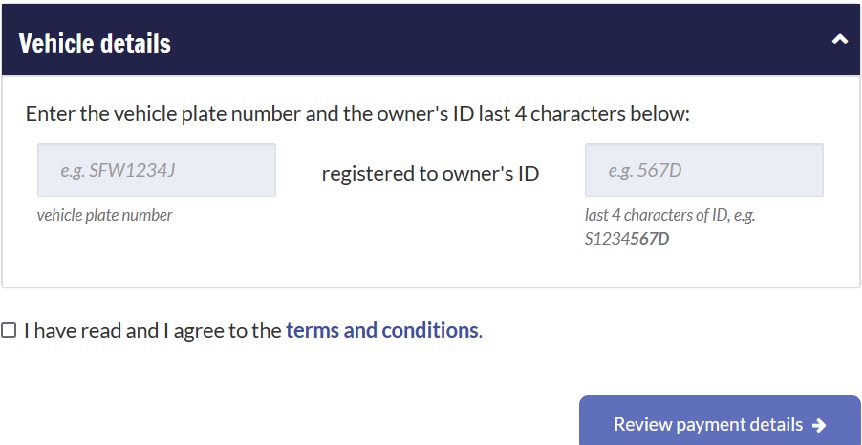

Step 1) Enter vehicle details and renewal period

Step 2) Review payment details

Step 3) Make payment

How to pay:

** SGQR PayNow

** eNETS debit (Internet banking account with DBS/POSB, OCBC, Standard Chartered Bank or UOB)

** Ensure that you have adequate balance and daily payment limit for the amount to be debited from your account. For assistance pertaining to your daily payment limit, please check with your bank before proceeding with the transaction.

** Please allow pop-ups for eNETS and your banks’ websites to avoid “time-out” errors arising from disabled pop-up blockers. For assistance, visit NETS’ website for steps on how to configure the pop-up blockers for various web browsers.

** Credit card or debit card (VISA or MasterCard only)

** Apple Pay

** Google Pay

** PayPal

Terms and Conditions for Renew Road Tax

This application is subjected but not limited to the following Terms and Conditions:

** These Terms and Conditions are supplemental to and are to be read together with the Conditions of Use found at the footer of the e-Services@ONE.MOTORING website accessed via onemotoring.lta.gov.sg.

** All capitalised terms used and which are not defined in these Terms & Conditions shall have the same meaning as ascribed to them under the Conditions of Use.

** Upon a successful renewal of road tax through the Website or at an AXS Station/iNETS Kiosk, a tax invoice/receipt shall be generated.

** The applicant has the option to renew his/her road tax for the vehicle for either 6 or 12 months, or any other licensing period as determined by the Registrar.

** The applicant is required to ensure that all pre-requisites required for renewal of road tax are fulfilled prior to the vehicle’s road tax renewal being considered by the Registrar.

The pre-requisites include and are not limited to:-

-Insurance coverage of at least third party risk for the period of road tax validity;

-Vehicle has valid periodic inspection certificate;

-Vehicle Parking Certificate (“VPC”) acquired for heavy goods vehicles and buses with seating capacity of more than 15 persons excluding the driver;

-Passing of the number plate seal inspection for Off-Peak Car (“OPC”)/Revised OPC, Weekend Car (“WEC”), Classic and Vintage scheme vehicles; and/or

-Warrant clearance from government or other related agencies.

** The applicant is advised to renew the road tax of his vehicle before it expires, as it is an offence for anyone to keep or use an unlicensed vehicle. Any person who uses or keeps an unlicensed vehicle is liable to a fine of up to $2,000 upon conviction in court. In the event that road tax has not been paid by the road tax expiry date as stipulated in the road tax payment notice (the “Expiry Date”), late renewal fee(s), in such sum as we may prescribe from time to time, shall also be payable.

** The applicant shall also note that it is a serious offence for anyone to use a vehicle without a valid insurance cover. The penalty for this serious offence is a fine of up to $1,000 or to imprisonment of up to 3 months or to both, and a mandatory disqualification from holding a driving licence for at least 12 months, upon an offender’s conviction in court.

** Where road tax has not been paid or renewed for a period of two and a half months or less from the Expiry Date, the applicant shall be able to pay or renew the road tax at any authorised collection centres, through the Website or an AXS Station/iNETS Kiosk.

** Where road tax has not been paid or renewed for a period in excess of two and a half months from the Expiry Date but 14 days before the date to attend court proceedings in this respect, the applicant may pay or renew such road tax through the Website or AXS Station/iNETS Kiosk.

** Where the road tax has not been paid or renewed for a period in excess of two and a half months from the Expiry Date and less than 14 days before the date to attend court, the applicant shall only be able to pay or renew the road tax at our office at 10 Sin Ming Drive, Road Tax Arrears Counter.

** The road tax and late renewal fee(s) shall be made through the available payment methods displayed on the subsequent payment page on the Website or AXS Station/iNETS Kiosk. We reserve the right to revise the road tax or late renewal fee(s) payable without prior notice.

** Any request for cancellation of road tax renewal, amendment of road tax renewal period or other changes will be at the discretion of the Land Transport Authority (“LTA”) and/or authorised collection centres. The prevailing cancellation or amendment fee shall apply at point of approval.

** The business transaction reference number and receipt number (generated and displayed on the tax invoice/receipt) must be quoted when making enquiries at our offices, through the Website or at any authorised collection centres.

** Without prejudice to the Conditions of Use, the LTA shall not be responsible or liable for any damages, losses or expenses including direct, indirect, special, punitive, economic or consequential losses and damages, howsoever arising from or in connection with this application.

** You declare and certify that you are the registered owner of the vehicle which is the subject of this application or, if you are not, that you have been authorised by the registered owner to submit this application on his behalf and to be bound by these Terms and Conditions.

** Consent for collection, use and disclosure of personal data: You consent to us collecting from and/or disclosing to any other Government agency or public authority, and/or using, your personally identifiable data, including those that you have provided in this application, so as to serve you in an efficient and effective way.

In addition, you consent to us collecting from and/or disclosing to any person (whether a natural person or a body corporate), and/or using, your personally identifiable data

(i) where such person has been authorised to carry out any specific service on behalf of the Government or a public authority;

(ii) in accordance with legislation under our purview to enable us to perform our functions or duties;

(iii) to comply with any order of court;

(iv) to comply with any written law;

(v) to enable a Town Council to enforce, investigate and/or prosecute an offence under its purview;

(vi) for the purpose of any legal proceeding involving any motor vehicle, power-assisted bicycle and/or personal mobility device registered with us; or

(vii) for the purpose of taking any action against any person for the breach of any of our terms and conditions. Data provided to us may be used for verification and record of your personal particulars, including comparing with information from other sources, and may be used to communicate with you.