Inland Revenue Department Nepal IRD : e-TDS Electronic Tax Deduction at Source System

Organization : Inland Revenue Department

Type of Facility : e-TDS Electronic Tax Deduction at Source System

Country: Nepal

| Want to comment on this post? Go to bottom of this page. |

|---|

Website : https://ird.gov.np/

e-TDS Electronic Tax Deduction at Source System

e-TDS is an Internet based system. This allows access to any withholders, withholdees and tax officers from anywhere. Effort has been made to simplify the system so that the system can be operated without any training.

Related / Similar Service :

Nepal IRD Income Tax Return E-Filing

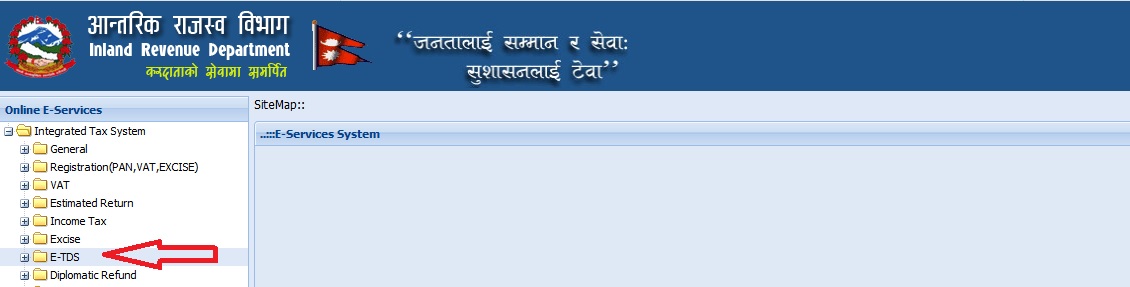

Accessing e-TDSS :

Access to e-TDSS is from the official website of Inland Revenue Department which is www.ird.gov.np. In the top menu there is a menu item, which reads e-TDS System. By clicking the link user will be directed to e-TDS System site.

Getting a Transaction Number

First step to enter monthly TDS information by the withholder is to book a transaction number for the concerned period. To do this, users have to click ‘Get Transaction Number’ menu in the top. System will then ask user to enter as:

1. User Name

2. Password

3. Re-confirmation of Password

4. Permanent Access Number (PAN) if available

5. Name of the Taxpayer Entity

6. IRO Name. Respective Inland Revenue Office where TDS will be submitted by withholder.

7. Valid Email

8. Current Contact phone

9. Address

10. The period for which TDS records are being entered.

11. If your voucher date is older than 2068.04.01, you need to insert the voucher date in order to get older account head else you will get the new revenue account head.

After entering this information and submitting the information system will assign a unique number (e.g., 6200000123) and display it to the user. User can proceed to enter TDS records from this step itself or enter TSD records later.

Confirmation

Confirmation Page for Transaction Number, Username and Password. Users have to remember the transaction number, username and password. It is used to further Add, Edit and Delete transaction and voucher information. Transaction number is also used to verify the records from Tax officers.

Entering TDS records

To enter the TDS records user can either enter the TDS records right after receiving transaction number or user can enter TDS records by clicking ‘Enter TDS Records’ menu. System will then ask user to enter TDS information such as:

** PAN Number of withholdee: If withholdee does not have PAN number then this field should be left blank.

** Name of the withholdee: If PAN number is entered then name is not mandatory since system will pull the name from the database otherwise Name of the withholdee is mandatory.

** Payment Date: This can be entered both in Bikram Sambat (BS) as well as English Date (AD) both ‘YYYY-MM-DD’.

** Payment Amount.

** TDS Amount deducted.

** TDS Type: This is a drop down list and users have to select the appropriate item as reason for tax deduction.

Once above information is entered user has to press ‘ADD’ button to save the record. This action will save the record and system will be ready to receive next record. User can also Edit or Delete the saved records by clicking ‘Edit’ or ‘Delete’ by the right side of the saved records which are displayed in the bottom.

Entering Voucher Information

Next Step is to Enter Voucher Information; users can click on the link ‘Insert Voucher Information’ of the Transaction Page.

Withholder is required to deposit the TDS amount in different treasury account heading according to TDS type in separate vouchers. These voucher information needs to be entered in the TDS System. To enter voucher information user will require accessing ‘Enter TDS Information’ link and by entering user name, password and transaction number and then selecting ‘Insert Voucher Information’ link. System will then prompt for the following information:

** Treasury Account Number: System will provide only those account numbers, which has been entered as TDS type.

** Voucher Number.

** Mode of payment (Bank or Cash)

** Payment Date in Bikram Sambat(BS).

** Bank: Select bank from the list provided.

** Branch Code: If branch code is not known click ‘Branch Code’ on top of field. System will display the list of branch with the branch code. Enter the required branch code.

** TDS Amount: The total voucher amount under this treasury account number.

Once above information is entered user has to press ‘ADD’ button to save the record. This action will save the record and system will be ready to receive next record. User can also edit or delete the saved records by clicking ‘Edit’ or ‘Delete’ by the side of the saved records, which are displayed in the bottom.

Printing TDS Form

Once TDS records and voucher information are entered user can print the TDS form by selecting ‘Print Preview’. System will then display the TDS format, which could be printed for submission to the tax officer along with the photocopies of the vouchers of payments to the bank.

How we can see our tds online which we have already filled?

I have lost the username and password. Is there anyway to reset the password?

Can’t e-tds be verified by our self?

You have to go to inland revenue department to verify E-TDS .

Please let me know how to feel the voucher after keeping record in transaction form